Original Link: https://www.anandtech.com/show/4122/intel-settles-with-nvidia-more-money-fewer-problems-no-x86

Intel Settles With NVIDIA: More Money, Fewer Problems, No x86

by Ryan Smith on January 10, 2011 9:20 PM ESTNVIDIA and Intel just released their respective PR announcements a bit ago, but after much rumor mongering it’s official: Intel and NVIDIA are the latest duo to bury the hatchet. This comes on the heels of 3 other major Intel actions in the past two years: the EU fining Intel (which is still under appeal), Intel settling with AMD (affirming GloFo as a legal venture), and Intel settling with the United Stated Federal Trade Commission.

With the exception of the EU fine that is still under appeal, this is the final outstanding major legal battle for Intel over their actions of the first decade of the 21st century. Generally speaking someone is always suing Intel – or Intel is always suing someone else – but as far as normality is concerned this is a return to normal for Intel: they’ve now settled with every significant government and corporate entity and are no longer living under a cloud of allegations from a number of parties.

So what are NVIDIA and Intel burying the hatchet over? A lot of this has to do with the same matters we saw in the FTC suit, as part of the FTC’s case was built on NVIDIA’s complaints. As you may recall the FTC didn’t get everything they wanted, and this suit looks to resolve those outstanding issues along with settling NVIDIA’s chipset allegations, and providing NVIDIA with a sizable 1.5bil compensation package for their troubles.

Background

The state of the United States patent system is such that it’s difficult if not impossible to design and build a high-tech product without infringing on someone’s patent. Snark about patent trolls aside, there are often only a handful of good methods to implement a given technology, and all of those methods are patented by someone. For these reasons there are a number of broad cross-licensing agreements in the GPU and CPU markets so that all the major manufacturers can design and build products without running afoul of another’s patent portfolio. AMD and Intel cross-license, AMD and NVIDIA cross-license, Intel and VIA cross-license, etc. Most of these cross-licensing agreements have the participants as peers, with each side getting access to the patents they need to make their agreements equal in value.

In 2004 Intel and NVIDIA went to the table, as the growing GPU market and its increasingly complex technology put Intel at risk of violating NVIDIA’s patents. This was primarily over Intel’s IGPs, which eventually would run afoul of NVIDIA’s graphics patents. In return for NVIDIA licensing the necessary patents to Intel so that Intel could continue producing chipsets with IGPs, Intel in return would license to NVIDIA their front side bus (FSB) and future buses (e.g. DMI). This is what allowed NVIDIA to enter the Intel chipset market with the nForce 4 Intel Edition chipset and to continue providing chipsets and IGPs up through the current 320M chipset.

It Seems You Can't Build One of Those, Without Licensing The Patents Behind One Of These

Although Intel and NVIDIA have never been “close” in a business sense, the modern sabre-rattling between the two doesn’t start until around 2008. At the time NVIDIA was moving forward with CUDA and G80 in order to gain a foothold in the high margin HPC market, while at the same time Intel was moving forward with their similarly parallel x86-based Larrabee project. In the FTC case we saw the fallout of this, as the FTC charged Intel with misrepresenting Larrabee and for lack of better words badmouthing NVIDIA’s GPGPU products at the same time.

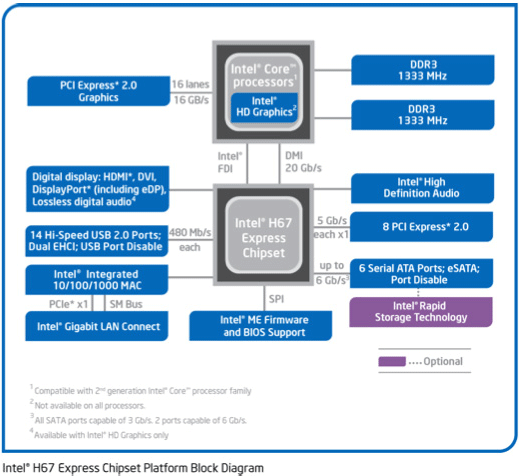

As far as the Intel/NVIDIA license agreement is concerned however, it was the end of 2008 when events were set in to motion. When Intel moved from the Conroe (Core 2) architecture to Nehalem (Core iX), they dropped the AGTL+ FSB in favor of two new buses: Quick Path Interconnect (QPI) for high-end desktop CPUs and workstations/servers, and extended the existing DMI bus from a Northbridge-Southbridge interconnect to a CPU-Southbridge interconnect as Intel integrated the Northbridge on-chip. Even though DMI had been around for a while, NVIDIA had never used it before as they used their own interconnect for early 2-chip chipsets, and later went to a single chip entirely.

We don’t have access to the 2004 Intel/NVIDIA agreement, but what resulted is a dispute about just what NVIDIA’s half of the agreement covered. If you ask Intel, NVIDIA’s agreement only covers AGTL+, meaning NVIDIA would not be allowed to make chipsets for Nehalem generation CPUs. If you ask NVIDIA, Intel was playing games with the agreement’s language to lock NVIDIA out of the chipset market while still keeping the agreement in force so that Intel could continue producing IGPs.

The end result is that in early 2009 the two parties filed suit against each other. Intel’s suit asked for the courts to affirm that NVIDIA did not have rights to DMI/QPI and that NVIDIA had breached the agreement by claiming they did have rights. NVIDIA’s suit in return was filed as a response to Intel’s suit, with NVIDIA claiming that Intel’s claim had no merit and that by doing so Intel was in violation. These suits have been ongoing up until today.

The suits further branch out with the FTC’s suit. While filing their suit against Intel, NVIDIA also made formal complaints to the FTC, who was already building a cast against Intel for actions against AMD. The FTC included some of their complaints in their own suit, and when that was settled last year NVIDIA received some protections against potential Intel actions. For all practical purposes Intel is barred from making technical decisions that lock out 3rd party GPUs from their platforms for the next several years, enforced by requiring they continue to offer PCI-Express connectivity and at the same time barring Intel from making changes that would reduce GPU performance unless those changes specifically improve CPU performance.

The Settlement

As was the case with the AMD/Intel settlement, today’s settlement with NVIDIA paints Intel as being the loser in the proceedings. Officially both sides are settling their differences and dropping their suits, however the terms of the settlement look to be in NVIDIA’s favor versus Intel’s favor.

The biggest (or at least, least ignorable) component of the settlement is a cash settlement between Intel and NVIDIA. Intel will be paying NVIDIA a total of 1.5 billion dollars as part of the terms of the settlement. This is larger than the EU fine ($1.45bil) and larger than AMD’s cash payout ($1.25bil). Notably, this is not a lump sum but rather will be paid in installments. As per the new six year cross-licensing agreement between the companies, Intel will be paying a portion of the settlement for each of those six years - $300mil on January 18th of this year, another $300mil on 2012 and 2013, followed by $200mil in 2014-2016. As a result this doesn’t give NVIDIA an immediate and large cash infusion, but it will add to their bottom line for the next several years; NVIDIA has never had a yearly loss larger than the Intel payments, so it’s safe to say that they are likely going to be in the black for the next six years even if their operations generate a loss.

The cash settlement goes hand-in-hand with the rest of the settlement, which settles the outstanding legal ambiguity about the previous Intel/NVIDIA chipset licensing agreement, along with establishing a new six year agreement between the companies that largely extends the previous chipset agreement.

The most notable bit here is that the chipset license agreement will now formally define that NVIDIA does not gain rights to DMI/QPI, which the agreement defines as being Intel processors with an on-chip/on-die memory controller. So while the company can continue to produce C2D chipsets, they will not be able to produce a Nehalem or Sandy Bridge chipset. This seems to be quite alright with NVIDIA, who claims they are done making chipsets – as far as we know they wound-down their chipset operations some time ago, and the GeForce 320M chipset (seen in Apple’s 13” and 11” notebooks) was the final chipset for the company. This also recognizes the long-term problem with producing a chipset for these processors, as with an on-die memory controller there’s little for NVIDIA to do on DMI-based CPUs beyond adding a south bridge (although we would like USB 3 support…). One way or another the 3rd party chipset market is dead.

|

Intel/NVIDIA Settlement |

|

| NVIDIA Gets | NVIDIA Doesn't Get |

| 1.5 Billion Dollars, Over six Years | |

| 6 Year Extension of C2D/AGTL+ Bus License | DMI/QPI Bus License; Nehalem/Sandy Bridge Chipsets |

| Access To Unspecified Intel Microprocessor Patents. Denver? | x86 License, Including Rights To Make an x86 Emulator |

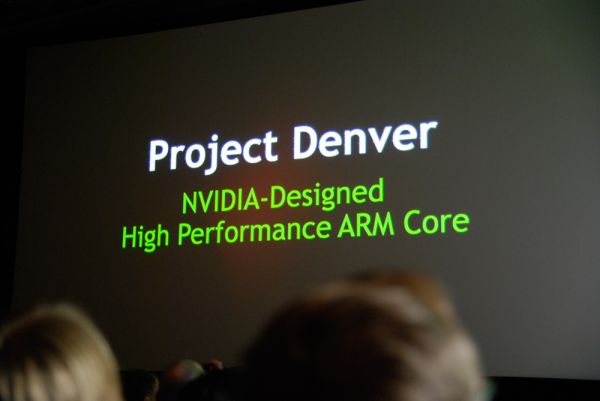

NVIDIA also does not get an x86 license. x86 is among an umbrella group of what’s being called “Intel proprietary products” which NVIDIA is not getting access to. Intel’s flash memory holdings and other chipset holdings are also a part of this. Interestingly the agreement also classifies an “Intel Architecture Emulator” as being a proprietary product. At first glance this would seem to disallow NVIDIA from making an x86 emulator for any of their products, be it their GPU holdings or the newly announced Project Denver ARM CPU. Being officially prohibited from emulating x86 could be a huge deal for Denver down the road depending on where NVIDIA goes with it.

So what does NVIDIA get out of this? On top of the 1.5 billion dollars, much of it is a continuation of the status quo: the six year chipset agreement (amended to explicitly forbid QPI/DMI) will be extended another six years. However there’s one item that sticks out in our minds based on the NVIDIA conference call this afternoon: Denver.

Last week’s announcement of Project Denver firmly established that NVIDIA is making its bet on ARM and not x86, and today they reiterated that not having an x86 license is not a problem for the company because they don’t intend to make an x86 processor. However based on what little we know about Denver it certainly is going to compete with Intel’s CPUs at some level. To this end, NVIDIA specifically mentions that they are getting access to Intel’s “microprocessor” patents, excluding the x86 (and XScale) technologies we previously mentioned.

Although this is not laid out in the settlement (because the settlement refers to the original agreement, which is confidential), NVIDIA has made it clear that the agreement gives them the right to “take advantage” of Intel’s patents for the “types of processors” they’re building. Our best guess is that as a result this agreement includes at least a partial preemptive settlement over Project Denver. Just as NVIDIA has many GPU patents Intel has many CPU patents, and it may be difficult to build a desktop/server CPU like Denver without infringing on those patents. If this is the case then today’s agreement implies that Intel and NVIDIA are cross-licensing to the point that Denver is mostly safe from Intel. While Intel’s approval isn’t necessarily essential for Denver like it would be for an x86 CPU, it clearly is easier to build Denver without the risk of Intel suing the pants off of NVIDIA again.

|

Intel/NVIDIA Settlement |

|

| Intel Gets | Intel Doesn't Get |

| Continued Access To NVIDIA's Graphics Patents | ? |

| No NVIDIA Nehalem/Sandy Bridge Chipsets | |

| No sharing x86 With NVIDIA | |

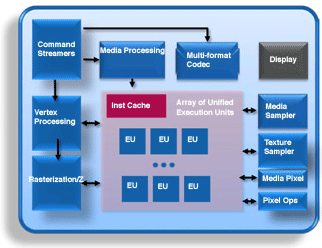

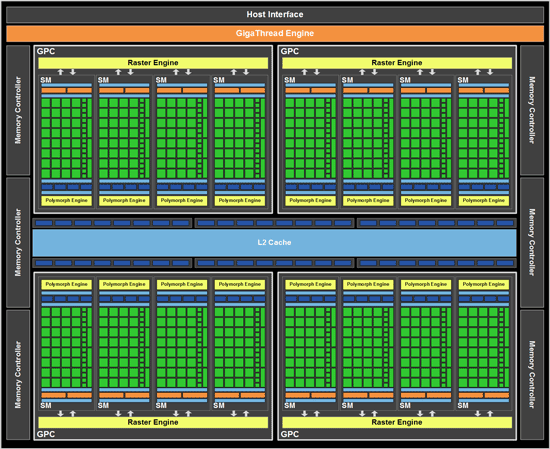

So we’ve established what NVIDIA gets, but how about Intel? The Intel situation looks to be much more straightforward. As we mentioned previously, NVIDIA and Intel originally cross-licensed in 2004 so that Intel could build IGPs using NVIDIA patented technologies and methods. That agreement was set to expire this year, which would have been a massive problem for a company whose CPUs almost always include a GPU. Today’s agreement with NVIDIA renews and extends that original agreement: Intel continues to cross-license with NVIDIA, allowing them to produce IGPs that use/infringe on NVIDIA patents. To be clear we believe this is a continuation of existing practices, and not any kind of agreement to integrate actual NVIDIA GPUs into future Intel CPUs as others have claimed elsewhere.

The rest of what Intel gets would appear to be gaining a market advantage through not having to give anything up. Intel doesn’t have to license x86 to NVIDIA, Intel doesn’t have to license DMI/QPI to NVIDIA, and if our reading is right Intel won’t have to face direct competition from NVIDIA using an x86-to-ARM emulator. This may not be an “exciting” outcome, but keep in mind that Intel already has some of the best gross margins in the chip industry, so to maintain status quo for the company is a big deal for them.

The Future

Wrapping things up, as we mentioned in our introduction this puts to rest one of the final pieces of outstanding litigation for Intel. They have settled with the FTC, they have settled with AMD, and now they have settled with NVIDIA. The only outstanding item is the EU’s fine, which may take a number of additional years to resolve, and in the meantime in light of the FTC settlement it’s hard to believe that Intel will win that battle.

At the end of the day NVIDIA is receiving 1.5 billion dollars, continued rights to make C2D chipsets, and unspecified patent protection for their ARM-based Project Denver CPU. Meanwhile Intel will continue to have access to NVIDIA’s graphics patents enabling them to produce IGPs, and some additional security in the x86 market by continuing to lock NVIDIA out of it. NVIDIA seems to have gotten the better end of the deal here, but Intel certainly got something out of the deal too.

| Intel Settlement & Fine Costs | ||

| European Union | AMD | NVIDIA |

|

~$1.45B

|

$1.25B

|

$1.5B

|

It’s worth noting that on top of the explicit costs of fighting these legal battles and the implicit costs of cross-licensing, these fights have taken their toll on Intel’s finances. They’re still a highly profitable company, but between the EU fine, the AMD settlement, and now the NVIDIA settlement Intel is on the hook for roughly 4.2 billion dollars. This is roughly the company’s net income for 2009 – or in other words so long as the company is functioning well their settlement costs are only a fraction of their profits over the past decade.

At the same time just because Intel has settled their legal matters doesn’t mean it’s smooth sailing for the chip fab company that has a design addiction. Intel is facing a competitive market in a whole new direction: mobile/SoC. x86 is firmly in their hands, but ARM and future generations of Atom are set to compete in the SoC market, and at the same time NVIDIA’s ARM-based Project Denver could upset the server market in a way not seen in years. Intel has their work cut out for them, and as we’ve seen should they falter there are plenty of other companies waiting to capitalize on the opportunity. Lawsuits, fines, and inquiries may sound scary, but the biggest threat to Intel remains all the other companies that want to take down the 800lb gorilla of the silicon world.