Original Link: https://www.anandtech.com/show/18874/nvidia-reports-q1-fy2024-earnings-bigger-things-to-come-as-nv-approaches-1t-market-cap

NVIDIA Reports Q1 FY2024 Earnings: Bigger Things to Come as NV Approaches $1T Market Cap

by Ryan Smith on May 25, 2023 9:00 AM EST- Posted in

- GPUs

- NVIDIA

- Financial Results

Closing out the most recent earnings season for the PC industry is, as always, NVIDIA. The company’s unusual, nearly year-ahead fiscal calendar means that they get the benefit of being casually late in reporting their results. And in this case, they’ve ended up being the proverbial case of saving the best for last.

For the first quarter of their 2024 fiscal year, NVIDIA booked $7.2 billion in revenue, which is a 13% drop over the year-ago quarter. Like the rest of the chip industry, NVIDIA has been weathering a significant slump in demand for computing products over the past few quarters, which in turn has dented NVIDIA’s revenue and profitability. However, while NVIDIA’s consumer-focused gaming division has continued to take matters on the chin, the strong performance of NVIDIA’s data center group has kept the company as a whole fairly profitable, with the most recent quarter setting a segment record and helping NVIDIA to avoid the tough financial situations faced by rivals AMD and Intel.

| NVIDIA Q1 FY2024 Financial Results (GAAP) | |||||

| Q1 FY2024 | Q4 FY2023 | Q1 FY2023 | Q/Q | Y/Y | |

| Revenue | $7.2B | $6.1B | $8.3B | +19% | -13% |

| Gross Margin | 64.6% | 63.3% | 65.5% | +1.3ppt | -0.9ppt |

| Operating Income | $2.1B | $1.3B | $1.9B | +70% | +15% |

| Net Income | $2.0B | $1.4B | $1.6B | +44% | +26% |

| EPS | $0.82 | $0.57 | $0.64 | +44% | +28% |

To that end, while Q1’FY24 was not by any means a record quarter for NVIDIA, it was still a relatively strong one for the company. NVIDIA’s net income of $2 billion makes for one of their better quarters in that regard, and it’s actually up 26% year-over-year despite the revenue drop. That said, reading between the lines will find that NVIDIA paid their Arm acquisition breakup fee last year (Q1’FY23), so NVIDIA’s GAAP net income looks a bit better than it otherwise would; while non-GAAP net income would be down 21%. Meanwhile, NVIDIA’s gross margins have held strong in the most recent quarter, with NVIDIA posting a GAAP gross margin of 64.6%.

But even a solid quarter during an industry slump is arguably not the biggest news to come out of NVIDIA’s most recent earnings report. Rather, it’s the company’s projections for Q2’FY24. In short, NVIDIA is expecting revenue to explode in Q2, with the company forecasting $11 billion in sales. Should it come to fruition, such a quarter would blow well past NVIDIA’s previous revenue records – and shattering Wall Street expectations. As a result, NVIDIA’s stock has already taken off in overnight trading, and by the time the market opens a bit later this morning, NVIDIA is expected to be a $930B+ company, knocking on the door of crossing a market capitalization of a trillion dollars.

NVIDIA Reporting Segment Results

| NVIDIA Segment Results, Q1 FY2024 (GAAP) | |||||

| Q1 FY2024 | Q4 FY2023 | Q1 FY2023 | Q/Q | Y/Y | |

| Data Center | $4,284M | $3,616M | $3,750M | +18% | +14% |

| Gaming | $2,240M | $1,831M | $3,620M | +22% | -38% |

| Professional Visualization | $295M | $226M | $622M | +31% | -53% |

| Automotive | $296M | $294M | $138M | +1% | +114% |

| OEM & IP | $77M | $84M | $158M | -8% | -51% |

But first things first, let’s take a look at the performance of NVIDIA’s individual segments. The bellwether of NVIDIA’s product portfolio over the most recent quarter was unambiguously the company’s data center segment, which booked $4.3B in revenue. The data center segment is doing most of the heavy lifting for NVIDIA’s revenue right now, as the other major segment, gaming, and most of the minor segments are all down year-over-year. In comparison to those other segments, data center revenue wasn’t just up 14% year-over-year, but it set a new record for the company.

This also marked the first quarter where NVIDIA’s data center revenue eclipsed Intel’s data center revenue – though it may very well have been a fluke based on an unusually weak quarter from Intel ahead of higher volume shipments of Sapphire Rapids CPUs. Either way, quarters like these underscore why all three of the big PC chip makers are chasing after the data center market, as the profitability significantly eclipses the consumer market.

Encompassing both NVIDIA’s data center compute products (GPUs, CPUs, etc) as well as NVIDIA’s ex-Mellanox networking products, NVIDIA is attributing most of the growth of this segment to growing demand for GPUs for use with large language models (LLMs) and other types of generative AI. As hinted at by the explosion in public interest in ChatGPT and other products late last year – and the subsequent knock-on effect it’s had on NVIDIA’s data center GPU sales – major technology companies seem to be investing significantly in snapping up GPUs for AI training and inference. NVIDIA is reporting that cloud service providers and consumer internet companies were the big drivers of growth, leaving enterprise sales as more consistent, and networking sales were down versus the year-ago quarter.

NVIDIA, in turn, is expecting the demand for their data center products to remain strong, even as they continue to ramp up the production of H100 HPC accelerators, L-series server cards, and the first Grace CPU-based products. As a result, the expectations for NVIDIA’s data center segment are very high, as NVIDIA is in an extremely favorable position given the demand for server and data center GPUs – perhaps even more so than the peak of the most recent cryptocurrency boom.

NVIDIA’s consumer-focused gaming division, on the other hand, was more of a mixed bag. At $2.2B in revenue, sales of GeForce and other cards were down significantly over what was largely the final quarter of the cryptocurrency boom and the overall pandemic-boosted rush on compute products in the consumer space. The 38% YoY drop comes as NVIDIA’s direct customers are still drawing down their product inventories (particularly now last-gen RTX 30 series parts), and RTX 40 series shipments are still picking up with the launch of larger parts of the product stack for desktops and laptops.

Still, $2.2B in gaming revenue actually beat some analyst expectations for the segment. So while NVIDIA’s gaming sales are down significantly, they’re apparently down a bit less than industry watchers were expecting.

Moving down the list, NVIDIA’s professional visualization segment largely follows their gaming segment in both good times and bad. So with revenues down 53% to $295M on a year-over-year basis, the most recent quarter was an especially rough one. Partners are still doing inventory draw-downs, though the introduction of new products is helping to turn things around.

The automotive segment, on the other hand, was NVIDIA’s other growth segment for the quarter, with revenues jumping 114% for the quarter to $296M. While this segment has still yet to become a break-out segment for NVIDIA, sales have been looking consistently better since the launch of their Orin platform and the associated jump in overall sales.

Finally, NVIDIA’s OEM & Other segment was another that saw significant declines, dropping 51% to $77M. According to the company, this was primarily driven by lower sales of entry-level GeForce MX GPUs.

Looking Forward: Aiming to Beat NVIDIA’s FY2020 Revenue in a Single Quarter

But for as solid as NVIDIA’s Q1 report was in an otherwise tepid technology market, the other half of the story relating to their latest earnings release comes from what will happen next. Or rather, what NVIDIA is projecting.

For the second quarter of their 2024 fiscal year, NVIDIA is projecting $11 billion (plus or minus 2%) in revenue. This would be a massive, 64% year-over-year jump in total revenue for the company, and a nearly as large 53% increase over Q1. And, as NVIDIA tells it, it’s not going to be a fluke.

Driving this massive jump in revenue is expected to be a boom in NVIDIA data center product sales, especially as production of NVIDIA’s high-end data center products continues to ramp. Business interest in AI has already created significant demand for the H100 and other accelerators, and that demand isn’t expected to abate any time soon as NVIDIA assembles an ever-larger number of accelerators. In order to keep up, the comapny has already ordered "substantially more" GPUs for the second half of the year, based on that initial boom in demand.

All pithiness aside, artificial intelligence is clearly the growth driver for the data center market across the entire industry right now, and NVIDIA’s control over the lion’s share of that market has them standing to benefit the most from the demand.

If NVIDIA’s $11 billion quarter comes to pass, then it will lead to NVIDIA booking as much revenue as in all of FY2020 – or if you want to go to pre-pandemic times, FY 2018. All of which is significant growth for what was already a very large company before the pandemic.

That $11 billion quarter projection has also blown past analysts’ expectations for the quarter, which prior to the announcement were on the order of $7.2 billion.

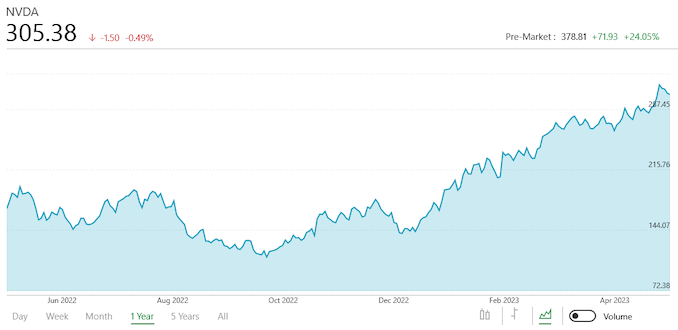

As a result, NVIDIA’s stock price spiked almost the moment they made their earnings release – and has stayed that high overnight – as investors adapt to new revenue expectations for NVIDIA. At about an hour before the stock market opens, NVIDIA’s stock is up $78 to $385, a 26% jump, and one with very few precedents even within the wild tech industry.

NVIDIA 10 Year Market Capitalization (StockAnalysis.com)

The large jump in NVIDIA’s stock price is also driving up NVIDIA’s market capitalization. When the markets open, NVIDIA is expected to open as a $930+ billion company, $175B+ higher than its market capitalization the night before. To put things in perspective, that is an entire AMD ($174B) in market capitalization growth, or a whole Intel ($121B) with change to spare.

This will also put NVIDIA on the doorstep of becoming the next trillion dollar company, a very elite club that, according to Bloomberg, only eight companies have hit before (and only 5 companies are members of now). NVIDIA is already the most valuable chipmaker (fabless or otherwise) by leaps and bounds, and this jump in market capitalization will further grow that gap.

But regardless of whether NVIDIA hits the $1 trillion mark or not, the company’s latest earnings report and subsequent stock price rally underscore the value of AI infrastructure – perceived or otherwise. The rest of the industry is eager to make sure that the story of artificial intelligence is not the story of NVIDIA, and to that end we should expect plenty of AI-related news and hardware developments to come.

Source: NVIDIA