Original Link: https://www.anandtech.com/show/16409/amd-ceo-dr-lisa-su-interview-on-2021-demand-supply-tariffs-xilinx-and-epyc

AMD CEO Dr. Lisa Su: Interview on 2021 Demand, Supply, Tariffs, Xilinx, and EPYC

by Dr. Ian Cutress on January 12, 2021 2:40 PM EST

Following the keynote press conference, AMD invited a number of key press partners for some Q&A time with Dr. Lisa Su. On the table, we were told, was any topic relating to AMD. Given that the company launched a number of products just as the previous year ended, and supply issues are tight for end-users, there were opportunities to quiz the CEO on production demand against supply, AMD’s product cadence, and expectations for 2021.

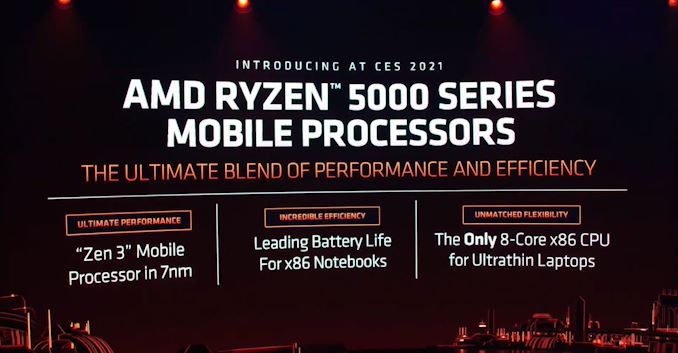

Topics on the front of mind were AMD’s announcements that had just come through the wire – the new Ryzen 5000 Mobile family, featuring an updated processor core, as well as target markets for gaming ultraportables as well as the best gaming notebooks AMD has ever been in. There was also a brief preview of AMD’s interplay in the enterprise market with next-generation Milan processors, and a tie in with the Mercedes AMG Formula 1 team, given that AMD provides a technical partnership.

This roundtable was a little different than most. Despite the whole discussion being on the record, AMD requested that we (or any of the press) did not post a full transcript of the call. Traditionally we post these transcripts, mildly edited for clarity and sometimes arranged for consistency – we fought our corner with AMD, and ultimately agreed to disagree. As a result, this Q&A will be more a ‘quote and explain’ situation.

Lisa Su: ‘AMD’s focus is about high performance and significant generational improvements; x86 is a strong ecosystem and we continue to invest heavily. Custom designs [like Arm] are in the market, and are purpose built for use. If anything, it is a validation about how much the demand for compute is growing. We see a larger opportunity for customized solutions for specific workloads, and AMD has a strong semi-custom division to meet those opportunities’.

My initial question to Lisa was about the emergence of Arm. It’s a question I have asked Lisa before, as well as AMD CTO Mark Papermaster, however this position of the market now is very different. Amazon’s Graviton2 is now being deployed widely over at AWS (read our review), and Ampere’s new 80-core Altra processor (read our review) sits at the top of the stack for single socket HPC performance. Our argument is that these Arm based models are encroaching on the traditional x86 market, and given Arm’s year-on-year expected performance gains from its roadmap ranging from 30% to 50%, if x86 is still focusing purely on high-performance compute, it might stand to be overtaken. Our goal with a question like this is to extract an idea of how AMD (and Intel, I asked a similar thing to CEO Bob Swan) plans to approach the competition, either by building above it, or using a two pronged approach between x86 and Arm. These would be the two high-level approaches we might expect.

Lisa’s answer was not particularly committal either way, instead citing the fact that as the industry is growing, it gives more opportunities for specialized products. If anything, according to Lisa, it validates the desire for compute and the agility to build for and target specific workloads. Not to say that we disagree with Lisa here, but the development of the Arm server ecosystem is for broad workloads, not simply specific markets. Lisa states that AMD at any time has its semi-custom division to take on these opportunities, although when asked if AMD has any semi-custom enterprise partners, Lisa cited the strong work the company is doing with the console market and spoke more to potential than a specific entity. No doubt if a company asked AMD to build a Neoverse chip, with some AMD secret sauce, they would.

In a similar vein, I approached the topic about Apple and its M1 chip. M1 is a clear building block for the company to move forward into desktops, workstations, and potentially the enterprise market. This has the potential to affect the relationship between Apple and AMD, especially if Apple decides to also branch out its graphics integration for its own solutions.

Lisa Su: ‘The M1 is more about how much processing and innovation there is in the market. This is an opportunity to innovate more, both in hardware and software, and it goes beyond the ISA. From our standpoint, there is still innovation in the PC space – we have lots of choices and people can use the same processors in a lot of different environments. We expect to see more specialization as we go forward over the next couple of years, and it enables more differentiation. But Apple continues to work with us as their graphics partner, and we work with them.’

A large part of the Q&A discussion was centered around supply and demand, especially given the notable lack of hardware on the shelves for end-users and enthusiasts. At a time when AMD has built out a number of products in a very compressed time frame, including consoles for two partners, it stands to reason that if users cannot buy the newest ‘leading performance hardware’, there are going to be complaints.

Lisa Su: ‘This is the result of a demand focused environment, rather than manufacturing issues. There is tightness in the supply chain due to demand, and that invariably puts pressure on our consumer, PC, and gaming product lines. As it relates to our semiconductor production, we’re putting in additional capacity to meet this unexpected demand. It will take time to catch up, but that’s what we’re seeing.’

When asked if this high demand environment and capacity ceiling would potentially cap AMD at 22% market share, Lisa said that AMD doesn’t believe that it will. Beyond actually building the silicon, Lisa also noted that there are substrate shortages, simply due to the increased demand, and that the ecosystem is working to also build additional capacity (including AMD investments), but that will take time and continue through 2021.

The question is always if and when this level of supply will improve to meet this increase in demand, and if AMD is still producing as many CPUs and GPUs as it can, where they might be going.

Lisa Su: ‘We are shipping lots of parts, and volumes in all segments are increasing, and that will happen through 2021. There will be tightness in the first half of the year, but alongside consumers we also ship to OEM partners. There is some real-time prioritization between end-user and OEM, but we understand that consumers want more and it’s very high on our priority list to meet this high demand.’

One element Lisa did speak to is how production level decisions happen in advance. AMD launched a lot of products in Q4 2020, including Ryzen 5000, Radeon RX 6000 GPUs, two games consoles, and also started shipping its next generation EPYC Milan processors. On top of all that, AMD had to build its new Ryzen 5000 Mobile processors to meet notebook demand in Q1 2021.

Lisa Su: ‘One of the things that was important with Cezanne (Ryzen 5000 Mobile) is that we were shipping for production in early 2021. With the OEM cycle of those products, enabling them to get the first batches of hardware in Q4 was vital for launch through the first quarter and the first half of 2021. This is how AMD matches its product cadence, and the choice on hardware manufacture is one of timing. It’s nothing fundamental, it’s not design limited, it’s all about making the right bets (sometimes months in advance) and enabling market estimation of demand. We had to enable millions of console APUs as well, and there is higher demand than we thought here as well. Working with OEM partners like Sony and Microsoft means enabling different strategies as well.’

The topic of pricing was also mentioned, not only due to low supply for end-users but also the expiration of US tariffs on electronics. Combined with this, the role of miners has also seen a sharp demand for some graphics solutions, making the pricing situation a lot worse. Lisa spoke to AMD’s strategy here for keeping prices lower than usual, but explained it’s not an immediately solvable solution.

Lisa Su: ‘We knew about the expiration of some tariff policies, and in advance worked towards a more flexible supply chain as it relates to AMD. We are committed to keeping GPU pricing as close to our suggested retail pricing as much as possible, because it’s the only way to be fair to the users. Normally when we have GPU launches, our own branded cards are available initially but then fade away for our partners to pick up. This time around we’re not phasing out our RX 6000 series, enabling us to sell direct to customers as low as possible. We’re encouraging partners to do the same. Not only tariffs, but the COVID environment has increased shipping and freight costs, which are hard to avoid. As we get into a more normal environment, this should improve. This also matters for our planned graphics updates through the first half of the year, as we have a lot of product coming to market.’

The topic came up that perhaps current 8-core on mobile, 16-core on desktop, and 64-core on enterprise were fundamental functional limits for these markets, in light of this round of products having the same core counts as the previous generations. Lisa commented that ‘There will be more core counts in the future – I would not say those are the limits! It will come as we scale the rest of the system.’ To that point, AMD’s design philosophy was a question on table, given that these design teams have a slow flow of personnel in and out of them. Lisa explained that:

‘Mark, Mike, and the teams have done a phenomenal job. We are as good as we are with the product today, but with our ambitious roadmaps, we are focusing on Zen 4 and Zen 5 to be extremely competitive. Also on GPUs, David Wang and the team focus on our long term roadmaps, and we pick the right mix of risk to get innovation, performance, and predictability. Bets are made, and we track the progress. We’re happy with RDNA2 on performance per watt, and overall performance, and we have a lot of focus on RDNA3. On elements such as AI specific integration, we are making investments. CDNA launched in November, and you will see us adding more AI capability to our CPUs and GPUs.’

On the topic of heterogeneous CPUs, pairing a high-performance core with a high-efficiency core, Lisa’s response was fairly telling, in that ‘our Zen 3 solution already scales very well from entry to enterprise, with the right mix of power, performance, and die area – to enable a heterogeneous design we have to find the right balance of cores, and we would have to see a significant value addition.’

Pivoting to more business operations, and the topic of AMD’s acquisition of Xilinx came into conversation. The deal announced last year for $35 billion in an all-stock acquisition has had its share of encouragement and detractors, questioning if the merger is the right time, the right fit, and if it makes sense to remove competition from the market.

Lisa Su: ‘We’re excited about closing the Xilinx deal; it’s the next big step in the story for AMD. There’s going to be a lot of technology going forward, and AMD has made good progress in recent years – we have deep customer partnerships, and we’re building trust to be behind the most important platforms. We want the largest enterprises to trust AMD as their supplier, and the Xilinx acquisition will help this. Xilinx is the right next step – we have the desire to have a much bigger footprint, and Xilinx will help AMD execute on its base business. Xilinx CEO Victor Peng will join us as part of that strategy, and we expect a seamless transition saying laser focused on execution. This is what leaders have to do – we have to expand and scale. AMD can do both’.

The last topic was on AMD’s business value, especially as it relates to how AMD integrates with its OEM partners and business customers. Lisa cited that growing the commercial and enterprise businesses were key targets for the company in 2021, especially as these are areas where AMD sees an opportunity for sizeable sustainable growth. Specifically Lisa was asked about how AMD’s strategy is going to develop based on recent improvements made from the competition.

Lisa Su: ‘For our Ryzen 5000 Mobile parts, we’ve stated that we will have 150+ design wins in 2021, which is 50% more than what we saw with Ryzen 4000 Mobile. Those numbers include our commercial system deployments, and we’re working hard enabling our security solutions in our Ryzen Pro platform – we already have a number of designs from top OEMs coming later this year. There will be new initiatives around Ryzen Pro as well. On the enterprise side, we are broadening our focus on EPYC, which means to say that we will have business solutions targeted to different vertical markets. This enables a faster time-to-market for those customers to deploy our solutions. We also started shipping Milan to OEM partners in Q4 last year as a lead up to this. More of this will come as we formally launch Milan in Q1.’

Round Up

In Q4 last year, AMD launched Ryzen 5000 for desktops, Radeon RX 6000 discrete graphics, was the silicon partner for the two major consoles that have sold in their millions, was shipping out EPYC Milan processors to customers, and was starting to build Ryzen 5000 Mobile processors for its OEMs to be ready for a Q1 launch.

In the first half of this year AMD is expecting to launch its 3rd Gen EPYC, the next generation of Radeon mobile graphics, more discrete graphics options, and we will see the deployment of Ryzen 5000 Mobile laptops and notebooks into the ecosystem.

If we combine Q4 with Q1 (and Q2), this is all at a time when AMD is experiencing higher-than-expected demand for its product line, and it appears it needs to order more from TSMC (as well as develop its substrate supply chain) in order to enable this. An order from TSMC might take a few months to come through, and so even with orders in place, AMD expects a tight supply through the first half of the year, but doesn’t see this as a theoretical ceiling on its market share numbers.

For other matters, the company still seems ambivalent about Arm’s potential progress, at least publically to the tech press. As solutions built on Arm come to market, as well as AMD’s own, you can be sure to read about here at AnandTech. But on that, AMD is looking to build out its enterprise offering to more focused verticals, which is certainly of benefit to both AMD and its customers. Some of these may be based in CDNA, AMD’s new compute accelerator architecture, and AMD is looking to increase AI support in future products. The Xilinx acquisition is still a critical business outlay to be considerate of, and is expected to complete by the end of the year.

For the longer roadmap, Lisa is clear that the company is working hard on Zen 4, Zen 5, and RDNA3. Future processors seem set to have higher core counts too.

We would like to thank Lisa and her team for their time.