Original Link: https://www.anandtech.com/show/15445/amds-fy2019-financial-report

AMD's 4Q/FY19 Financial Report: Revenue up 50% from 4Q18, Debt Halved

by Dr. Ian Cutress on January 28, 2020 4:51 PM EST- Posted in

- CPUs

- AMD

- GPUs

- Financial Results

AMD just announced its 4Q 2019 and Financial Year 2019 Earnings Report. Here are the key points, along with AMD's presentation.

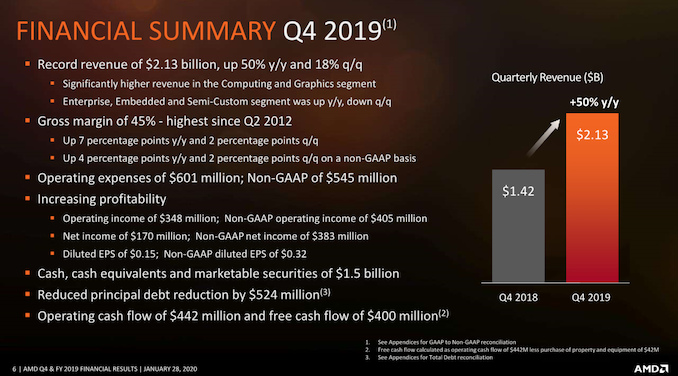

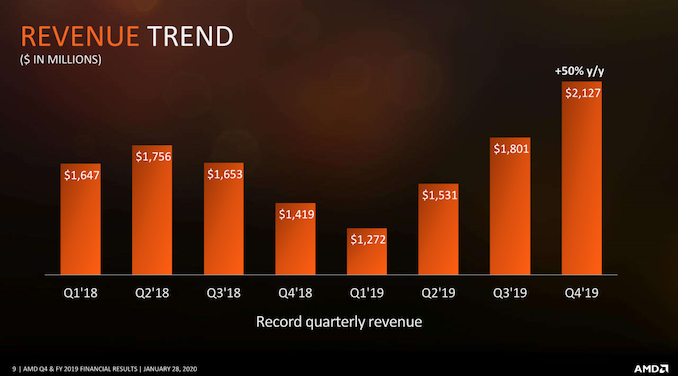

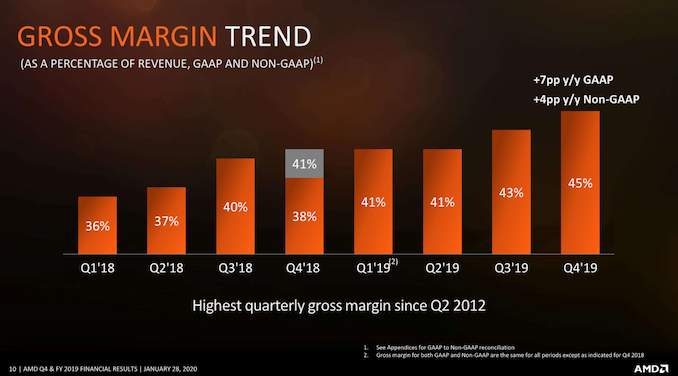

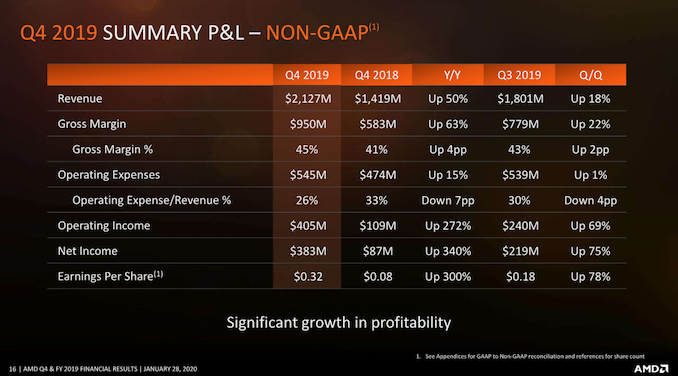

Today AMD announced its 4Q 2019 revenue of $2.13 billion, up 18% from the previous quarter and up 50% from the same quarter last year. This is accompanied by a 45% gross margin for Q4, AMD's highest on record, up from 38% from Q4 last year and up from 43% in Q3. Operating income for the quarter was up a staggering 1143% (not a typo) from $28 million a year ago to $348 million this quarter, and net income was up 347% to $170 million. The resulted in earnings per share of $0.15, up 275% from a year ago.

| AMD Q4 2019 Financial Results (GAAP) | |||||

| Q4'2019 | Q3'2019 | Q4'2018 | Q/Q | Y/Y | |

| Revenue | $2127M | $1801M | $1419M | +18% | +50% |

| Gross Margin | 45% | 43% | 38% | +2% | +7% |

| Operating Income | $348M | $186M | $28M | +87% | +1143% |

| Net Income | $170M | $120M | $38M | +42% | +347% |

| Earnings Per Share | $0.15 | $0.11 | $0.04 | +36% | +275% |

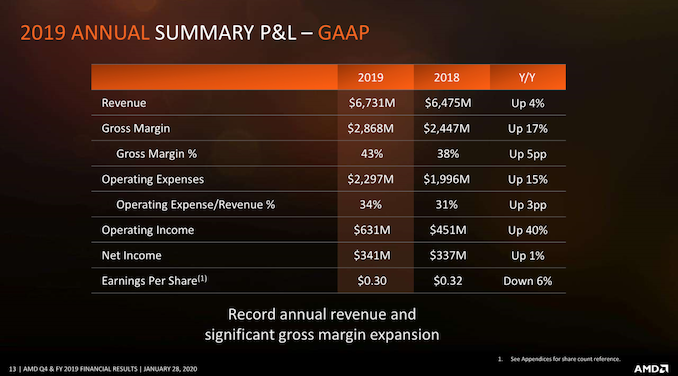

For the full financial year, AMD is reporting revenue of $6.73 billion, up 4% from 2018, and a full year gross margin of 43%, up from 38%. Operating income was up 40% to $631 million, but net income was almost flat at $341 million. Earnings per share for the full year were down 6% to $0.30.

| AMD FY 2019 Financial Results (GAAP) | |||||

| FY'2019 | FY'2018 | Y/Y | |||

| Revenue | $6731M | $6475M | +4% | ||

| Gross Margin | 43% | 38% | +5% | ||

| Operating Income | $631M | $451M | +40% | ||

| Net Income | $341M | $337M | +1% | ||

| Earnings Per Share | $0.30 | $0.32 | -6% | ||

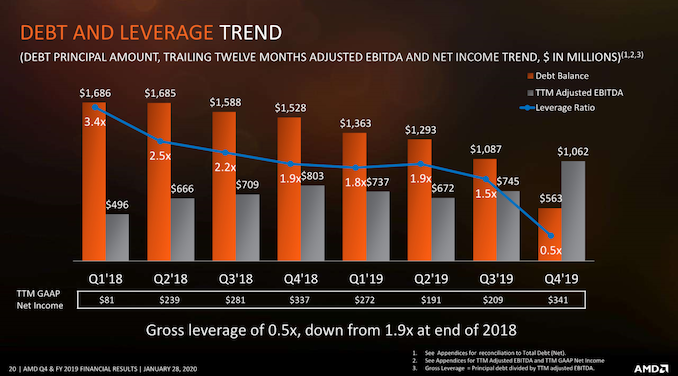

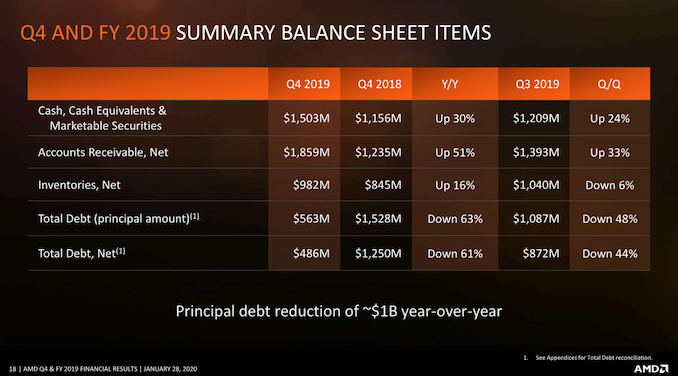

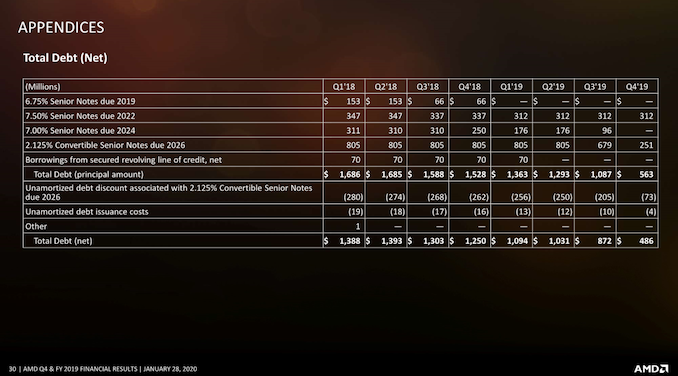

Within Q4, AMD paid down a lot of debt - down from $1087m in 3Q19 to $563m in 4Q19. AMD's strategy here is to pay down debt and strengthen its balance sheet - whether it ends paying off all of its debt is dependent on the types of debt and if there are better uses for the cash.

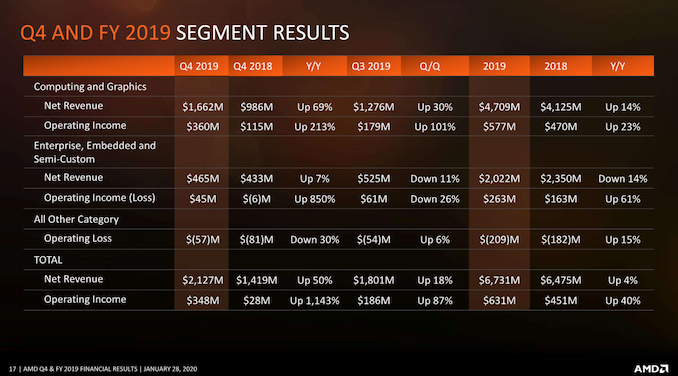

AMD's Q4 was driven by sales of its EPYC, Ryzen and Radeon hardware, with the Ryzen 3000 series ramping better (after mispredicting demand for products) and the launch of new Radeon 5000 series graphics cards. The EESC gain of +7% YoY is lower than I personally expected, driven by better EPYC sales but weaker semi-custom as we ramp into new consoles in the second half of the year - we have expected EPYC to be a big money spinner for AMD, but we're still waiting for that ramp to happen in significant numbers similar to Ryzen/Radeon as Rome gets a foothold in the server market. We expect the new Threadripper CPUs to make an impact in Q1/Q2, albeit minor given the size of the HEDT market compared to the standard desktop market.

| AMD Q4 2019 Computing and Graphics | |||||

| Q4'2019 | Q3'2019 | Q4'2018 | |||

| Revenue | $1662M | $1276M | $986M | ||

| Operating Income | $360M | $179M | $115M | ||

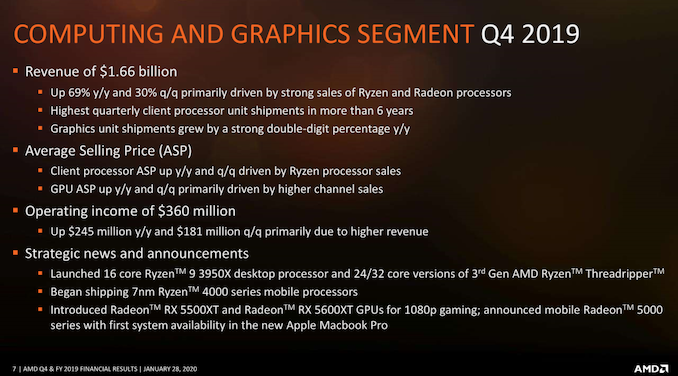

Computing and Graphics was the lion's share of the earnings gains, with revenue for this segment up 69% year-over-year thanks to strong sales of both Ryzen processors and Radeon GPUs for gaming. Operating income was also up thanks to the higher margins on Ryzen processors. Now that AMD can compete and win on performance, they don't need to sell at such a discount, which is of course what is helping them turn the corner.

| AMD Q4 2019 Enterprise, Embedded and Semi-Custom | |||||

| Q4'2019 | Q3'2019 | Q4'2018 | |||

| Revenue | $465M | $525M | $433M | ||

| Operating Income | $45M | $61M | -$6M | ||

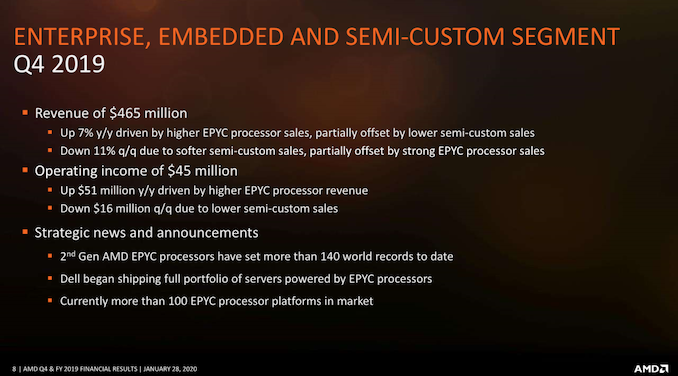

Enterprise, Embedded, and Semi-Custom didn't fare quite as well as the Computing and Graphics side of the house, although year-over-year the results are still up. The 7% revenue growth was helped by higher EPYC sales, but the aging console generation pulled the results down somewhat. It'll be interesting to see how the next gen consoles, with both Sony and Microsoft again announcing AMD internals, will help out over the next year. Operating income for this segment was $45 million for the quarter, up significanly from the $6 million loss a year ago, but AMD still has work to do here. The enterprise and hyperscale sales have much higher margins, but also much longer contract terms, so this isn't a market they will be able to penetrate overnight. They are making small gains, but still have a long way to go.

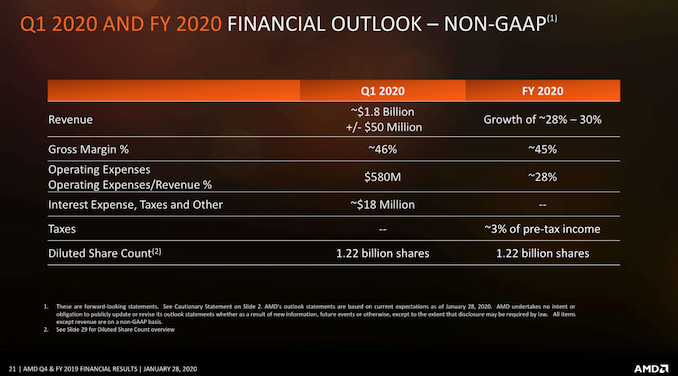

Expectations from AMD for 2020 is around 28-30% revenue growth, coming from product ramp (such as consoles and Rome), with an overall 45% margin. This margin has two factors - the server margin is going to be more than 45%, but typical console margins are less than corporate average, so that brings it down a little (although operating margin for consoles are actually higher). Looking at the shorter term, AMD is expecting Q1 2020 results to have revenues of about $1.8 billion, plus or minus $50 million, which will be 42% higher than Q1 2019, with margins around 46%.

AMD's official call is set here for 5:30pm ET, so we'll listen in and add anything extra said on the call.

Update 1: Points from the call, in no particular order:

- AMD is expecting its next-generation hardware in client and datacenter to be ramping in advance of the console launches in Q3/Q4 (AMD has clarified that this meant current generation 7nm about to hit the market, as with Ryzen Mobile 4000).

- In 2020, Navi will be refreshed

- In 2020, we will see GPUs built on next-generation RDNA

- Half of AMD's revenue is built on its 7nm product portfolio

- Semi-custom revenue was down 30-50% in 2H19 due to end-of-cycle consoles

- Current inventory is at $1 billion, which is down 6% from last year

- Trailing 12-month EBITDA is $1.1 billion

- 80% of semi-custom revenue for 2020 is expected in the second half of the year due to console launches

- Semi-custom revenue is expected to peak in Q3 for 2020.

Here is the AnandTech transcript of the call. Please link back to this page if you quote parts of the transcript.

Q&A

Bank of America Securities: Lisa, for my first one, you mentioned the goal is get to double digit market share in servers by the middle of the year. I'm just wondering how the visibility is around achieving this target. What's driving it? Is it just more instances at existing cloud customers, and as part of that, do you also have a shared target for exiting this year?

Dr. Lisa Su: We are very pleased with how Rome is ramping. You know, we've been in market now four to five months. With the cloud guys we have visibility in the public facing instances as well as what they're doing in terms of internal workloads. What we see is the breadth of the overall workloads that they're using Rome with is expanding.

On the enterprise side, with the full portfolio of our partners (HP, Dell, Lenovo, and the ODMs), we see a significant increase in the overall enterprise pipeline that we have for Rome. So we're very focused on continuing to grow share in the data center market, and we feel good about our mid-year market share targets. In terms of end-year market share targets, we'll talk a little bit more at our Financial Analyst Day. But certainly for 2020 we're very focused on growing our overall data center share.

Q: For my follow up, Lisa, how should we interpret the impact of capacity shortages at your main competitor? Have you seen any benefit from that? If not, why not? And then kind of Part B is [that] Intel did say that they plan to expand capacity later this year and will focus it more on the PC client side and try to reclaim market share. What effect will that have on the pricing in the market and does your full year outlook take any potential impact of that competition? Thank you.

LS: When we look at the PC market, we finished 2019 very strong, both in mobile and desktop. I think that's primarily on the strength of the product portfolio and the expanding customer platforms that we have. There are some discussions about 'pockets of shortages', but as I said before we've been on this steady increase in market share now for the last eight quarters, and we believe we gain share in Q4 as well. So I think what we see is just the portfolio getting a lot stronger. As we go into 2020. I think we are enthusiastic about our products. In addition to the Zen 2 based desktop products, we've added Zen 2 now in the notebook portfolio, and we'll have that for the full year of 2020. So I think our outlook expects growth in all businesses, including the PC business and we remain very focused on expanding our market presence in both consumer as well as commercial PCs.

Goldman Sachs: I was hoping to better understand some of the key assumptions behind your full year guidance for both your PC business as well as the server business. Can you talk to some of the TAM (total addressable market) assumptions that you're making and the market share assumptions for the full year?

LS: If you look at the PC market, I think the discussion so far has been to call 2020 flat to maybe down slightly. There has been some concern raised about the 2H20 perhaps being weaker than normal seasonality, just due to some of the enterprise refresh cycles that are strong in the first half. We're viewing it as flat, flat-ish, maybe down very slightly. That being the case, back to the comments I made before, I think we feel very good about our product portfolio. Especially when we look at our notebook share, and our relative opportunities to gain market share, the strength of our Ryzen 4000 series products is significantly stronger than previous generations and the platforms are also significantly broader. So we feel good about that.

In the data center market, again, I would say that the growth of computing continues. From our standpoint we see it as a good market environment for data center in both cloud as well as enterprise. When we look at our full year revenue guide of approximately 28% to 30% for the year, the highest growth from a percentage standpoint will obviously be server, given the expectations in that market. But we expect all of our businesses to grow nicely in 2020, and that's just based on where we are in the product cycle and the visibility that we have with customer design wins, as well as overall competitiveness.

Q: A quick follow up on gross margins, AMD is guiding Q1 gross margins to 46%, and then 45% for the full year. I appreciate your semi-custom business is at a low point in Q1 and the ramp is in Q2, and more more so in the second half, is probably dilutive to corporate margins. If you could walk through some of the puts and takes from a gross margin perspective for the year, that would be helpful. Related to that, if you can compare and contrast the gross margin profile of your semi-custom business going into the next cycle versus the past cycle that would be helpful. Thank you.

Devinder Kumar: Overall from margin standpoint, you got it right, we are guiding to the 46% in Q1, and then the semi-custom business, as we've said, is typically lower than the corporate average. As that product ramps in the second half it will have an impact on gross margin. The guide for the year is at 45%, so we feel good about that, having ended 2019 at the 43% level.

From a puts and takes standpoint, it's really about product mix. Lisa talked about the businesses ramping and growing in 2020, with the 28-30% growth in revenue. The data center, as we've said before, is above corporate average. The client gross margin is around corporate average, and some graphics and then the semi-custom business has below corporate average margins. That mix of revenue as it ramps throughout the year will obviously have an impact on a quarterly basis. From an annual standpoint, we feel pretty good to the guide at 45%, in particular with the 7nm products ramping as we get through the year, and that obviously benefits the gross margin. Lisa, do you want to chime in on the difference between generation to generation?

LS: As you said the semi-custom margins tend to be below corporate average on a gross margin basis, although on an operating margin basis, given the contribution from our customers for the R&D, it's actually quite good. As it relates generation to generation, the way to think about it is that in the first year of a console ramp, you would expect the margins to be on the lower side. That's true no matter what, just because you're just starting to product ramp, and you should expect that the margins will get better as that ramp continues over time.

Cowan: I wanted to just start with a question comparing and contrasting a little bit, that AMD is maybe a little weaker than some of us had modelled, and I guess due to the console stuff for Q1 and the guidance of 28-30% growth for the year. Maybe you could just sort of lay out the year a little bit at a high level and just how you guys are sort of thinking about it coming together.

LS: We're pretty excited about 2020. You know, it's a strong year for us, certainly with the expectations of 28-30% revenue growth. We do expect all of our businesses to grow. I think relative to the Q1 guide, if you look at Q1 as an absolute number it is up over 40% year on year, even with semi-custom revenues very low in Q1. That should give you an idea of the strength of the rest of the business.

From a sequential basis Q4 to Q1, it's what we said on the call - there is some bit of normal seasonality, as we are consumer focused in our PC portfolio. So you expect that would go down from Q4 to Q1. Then we do have the factor that the semi-custom profile when we're doing a product transition has the revenue very low in Q1. It then starts ramping Q2, but it's very heavily weighted in the second half of the year. So you should think about semi-custom for this year that over 80% of the revenue for semi-custom will be in the second half of the year compared to the first half of the year. So overall, we think a very strong year, a little bit of re-profiling of revenue, particularly as it relates to semi-custom and we look forward to executing it.

Q: It looks like on the operating expense side, you're going to be up in a neighborhood of mid 20s for the full year in the annual guidance that you outlined. Maybe you could talk a little bit about the focus of that - is it branding and marketing in the PC and server spaces as you grow? Or is it in other areas in R&D? Then secondly, I think you guys had disclosed the data center revenue mix, of GPU plus server in prior quarters, and if you have that number handy, that'd be really helpful. Thank you.

DK: Let me take the second one first. With the data center it's as we said in the past it is mid-teens of revenue, and this quarter it is around the same mid-teens of the total revenue and I'll point out that it is record revenue in the quarter, so that's pretty good about that. We feel pretty good about having mid-teens revenue in the data center, combined server and data center GPU on revenue of $2.1 billion.

As far as OpEx is concerned, our guide for the year is about 28% of the revenue. You are right, fundamentally the investments are in R&D and go-to-market, and obviously the business is growing, so there's investments needed to go ahead and grow the business from an absolute standpoint. We feel we can manage it to about 28% of of our revenue overall for the year.

LS: The only thing I'll add to that is that for the data center revenue, particularly in Q4, it was very heavily weighted towards Server CPUs, just given some of the lumpiness of the data center GPU revenue.

Jeffries: I think it's impressive that the cash that you generated 10 years ago, you were $4 billion in net debt, and now you are net cash positive - I didn't think back then we'd expect you to be here! But how should we think about capital structure going forward? For the $440 million in cash flow from operations, I had a challenge reconciling it - can you share the biggest two or three sources of cash? For Lisa, the last time AMD had a product cycle in servers I think once AMD hit 5% share, you started again share it a 2%-4%, a 400 basis point clip per quarter - what is the right kind of cadence or pace of share gains in servers this cycle? Maybe you could just talk about, structurally, what gaits the pace of your ability to gain share? Is it capacity from your suppliers, is it your own engineering support infrastructure, or is your customers testing and importing workloads? If you could give us a framework to think about that, I think that would be helpful. Thank you.

DK: You do have a long memory! So do I - I do remember the days when we had the challenge on the balance sheet, and one thing we feel good as we end 2019 is the strength of the balance sheet, and in particular the net cash position. We haven't been in this position in many, many years, as we pointed out in the prepared remarks.

From a capital standpoint, and with allocation priorities investing in the business, the revenue is growing significantly in 2020 is what we're projecting, at 28 to 30% over 2019. Also we want to invest in the roadmap to go to market and everything that's needed with the revenue ramps as significantly as it is, going from year over year. So that's really the allocation priorities.

From a viewpoint of where the $440 million comes from, you know, higher revenue, especially when you look at the revenue in Q3 and Q4 of 2019 compared to the first half of 2019, we they did go ahead and buy the inventory to go ahead and support the higher revenue. As you know, when you sell the revenue in particular, when it ramps up, you know, as a debt on better margins, it generates the cash. That's why you have the $440 million operating cash flow

LS: As it relates to the server rate and pace, I think the most important thing for us is when we look at from the time of announcement, or time of shipment, to how customers actually deploy and trying to shorten that cycle. So when I look at the difference between Rome and Naples, we've seen that time to deploy actually significantly shorten with Rome. In terms of rate and pace of server share gain, primarily for cloud customers it is having them deployed not just a set of instances but ensuring that they get fully built out across all regions in the world, and also adding additional support workloads. So for that it's just time is what I would say. As it relates to enterprise customers, I think the platform coverage that we have with Rome, is significantly broader than it was with Naples. I'm quite encouraged by the strength of the pipeline with the number of customers that are engaged and how they're deploying. I think we're going at a good pace, and will continue to accelerate that as we go through 2020.

Stacy Rasgon, Bernstein Research: First I have a question on gross margins. Into Q1, you said consoles are negligible, with gross margins are 46%, so that suggests that that 46% is basically indicative of the business as it stands without consoles. So does that represent kind of the peak of the gross margin on the current mix [of products]? I'm a little surprised it's not higher, given all the new products in aggregate we're supposed to have gross margins in excess of 50%, and most of the mix today should be new products. So how do we think about the Q1 gross margins in the context of that, and what are the drivers that take it higher from here. Is it basically just the mix of server parts, or there something else that can that can help with that?

DK: Lisa can add, but we talked about product transitions - with the 46% guide in Q1, we recently introduced the next generation notebook products. As product transitions go, you still have legacy product that you sell, before you get converted over to the new technology and the new generation products. The desktop products are ahead of that, from that standpoint, and that did benefit our margin in the 2019 timeframe. And you are right, the console has been negligible revenue in Q1 of 2020, and it does benefit the margin to 46%. From an overall standpoint for the year, it is 45%, and that's because the semi-custom business, which is lower than corporate average, does come back. As Lisa said earlier, we are expecting 80% of that in the back half of the year. But by that time, the new generation products in the other businesses, including data center and client, will be ramping all on 7nm and that should have the gross margin to offset some of the impact that we have on the semi-custom business.

LS: We don't expect the client notebook mix to fully cut over to 7nm until later in the year. In terms of opportunities to improve margins, it is definitely about product mix - so a higher mix of server as well as Ryzen 7 and Ryzen 5 versus some of the legacy products.

Q: If I sort of squint to the second half, it seems to me you're probably guiding it implicitly $800m to $1b over the second half of 2019. How much of that do you think is console versus non console, because it's not hard to get a console number, especially in the beginning of a ramp as it's not that far off that that initial number, which doesn't leave all that much room to ramp the rest of the business. So is this just conservatism or what else are you expecting here? How much of that second half do you think is console versus non-console?

LS: I think as I perhaps answered one of the earlier questions, when I look at the full year at 28%-30% revenue growth, we expect server to be significantly above that, and then the rest of the businesses are all going to grow nicely. You would expect significant double digit growth in the client business as well as the semi-custom business. Overall we see the aggregate of it to be a very strong year. So it is not all console weighted, if that's if that's what you're asking.

Q: Wouldn't you get that just from the nature of the ramp that we saw in 2019? I guess I'm trying to sort of normalize second half the second half with a strong double digits in second half versus second half growth across all the businesses.

LS: So what we said in 2019 overall we grew 4% on an annual basis, but excluding semi-custom, we grew over 20% through all the rest of the businesses. If I do that same type of calculation, excluding semi-custom for 2020, we would still say the rest of the businesses would grow greater than 20%.

Instinet: You said the sequential decrease in the quarter is driven primarily by the dropping of game console chips. Does that mean that you expect your microprocessor and graphics revenues will be flat sequentially? Or if not, roughly, what does your guidance team in terms of percentage say for PC processes and GPUs? Do you get server processes sales rising sequentially?

DK: I don't think I said specifically that Q4 to Q1 is all due to semi-custom, that obviously hurts the margin, but there is a product mix underneath that, especially with the notebook products that we talked about that are moving to seven nanometers.

Q: About revenues from December into Q1, the sequential drop. Can you give us some idea - I mean there's a big chunk that is game consoles, but what about the non-game console part of it?

DK: It seasonality in the business. We have the consumer weight from a revenue standpoint in our CG segment, and as we go from Q4 to Q1 you do get seasonality coming into play. Typical seasonality is what is driving the other portion of the decline in revenue from Q4 to Q1.

LS: I think what you're asking is, you know, we would expect that the Computing and Graphics segment would be down sequentially due to seasonality, and we would expect that the server CPUs should be up because we're continuing to ramp those processors sequentially.

Q: Lisa, can you give us some idea of what new GPUs you're expected to launch to the rest of 2020, for PCs and for data center?

LS: Yes. In 2019, we launched our new architecture in GPUs, it's the RDNA architecture, and that was the Navi based products. You should expect that those will be refreshed in 2020 - and we'll have a next generation RDNA architecture that will be part of our 2020 lineup. So we're pretty excited about that, and we'll talk more about that at our financial analyst day. On the data center GPU side, you should also expect that we'll have some new products in the second half of this year.

Morgan Stanley: You talked about consumer graphics as being below the corporate gross margin. I know you've historically had a high cost structure because of high bandwidth memory, but as the portfolio increasingly doesn't use high bandwidth memory, is there the prospect to improve that for consumer GPU to be closer to where your competitors close margins are?

DK: I don't think I've actually said that - I said some of our graphics products are below corporate average from a gross margin standpoint, in addition to the semi-custom have been below average.

LS: To answer your question in terms of what we expect in consumer graphics - We're investing in consumer graphics, and we think gaming is a very important segment, whether we're talking about consoles or discrete graphics. The work that we're doing around the RDNA architecture, and the future generations of RDNA architecture, we believe will continue to improve our offerings for both consumer graphics as well as data center graphics.

Q: With the new console builds, you mentioned that that starts in Q2, but it's mostly in the back half of the year. As you think about that opportunity from a unit standpoint, is it the right way to look at it with sort of similar number of units to what we had in the first year of the current console cycle? Or does the compatibility that you bring when you have an x86 CPU with little bit more similarity between the consoles - could that point us to a sort of a better console unit market in 2020, as we saw six years ago? How are you thinking about it?

LS: We do think there's some pent up demand for the next generation of consoles, you know, without forecasting what our customers are planning, I would say they're both planning for a strong first year and we'll have to see how things develop as we go through the ramp. But the overall sentiment is that there has been, you know, let's call it a lull in console sales in the second half of 2019 going into 2020, for some of this anticipation of the next generation.

Barclays: I just want to make sure I heard you right - I thought you said that semi-custom as well would grow double digits, I just want to confirm that. Just following on, I don't know what the units are going to be, but is there a fee story to lay on top of that equation as well?

LS: I did say that somebody custom should grow double digit as well. It's a strong year for us. Then as it relates to content, it's fair to say that there is additional content in this generation versus previous generation.

Q: On the gross margin equation, is there a way to talk about the mix of 7nm that's a big tail when it still seems early days, at least across some of your products? Is there a way to kind of think about the whole company and what the mix of 7nm is?

LS: We just completed the fourth quarter and it was a very strong quarter for us - record revenue for the company. I would say about half of that revenue was 7nm-based and the other half, you know, is not yet. There is still a significant ramp as we go into 2020. But we're pleased with how quickly we ramped in 2019.

Credit Suisse: I want to go back to the gross margin bridge from Q1 to the full year - I want to make sure I understand that the drop from Q1 to the full year, is that 100% being driven just by gaming coming back more aggressively in the back half of the year? Or have you baked in anything for either pricing competition from the number one guy out there, or some share shifts? How do we think about that? Is it all about gaming?

LS: I think if you look at it, the predominant factor if you're talking about Q1 guided 46% versus full year at 45%, it's just as we wrap those consoles, there's some there's some impact of that. As it relates to the pricing environment, we're expecting a competitive pricing environment, and that's the way we built our model. We've always expected that the competition will be very aggressive on both the CPU as well as the GPU side - that is part of the inherent model or for the company.

Q: You guys have a ton of goodness on your immediate plate on the server side and the data center side, just with the workloads you're going after. But I'm kind of curious - you answered an earlier question saying you expect more GPUs for the data center and I don't want you to pre-announce product, but how should I think about your positioning for AI as a workload and acceleration? Given some of the heavy lifting that NVIDIA had to do around CUDA, how do I think about the investment there? Is this an area that you think you have some unique IP that you can bring to, or how do I think about that over the next couple of years?

LS: I think that's actually a good way of talking about the opportunity. The CPU opportunity is very immediate and in front of us as we look at the opportunities with Rome and the expanding opportunities. I think the data center GPU market continues to be an important growth vector for us and I call that over the several year horizon. When you look at the opportunities that we have, when we combine our CPU and GPU IP together, they're very, very strong. For example this is the reason that we won the Oak Ridge National Lab, the supercomputer with Frontier, which were actually both a CPU and a GPU win. With some of the optimization that we've done with that overall system, we think that there are additional opportunities like that, as well as machine learning and AI opportunities. Our focus there has been to work with large cloud providers to optimize the machine learning frameworks. We had some key milestones that we completed in the fourth quarter, that will continue to be a focus for us in 2020 and beyond.

Q: Is it fair to say that some of the GPU data announcements this year go beyond just the cloud gaming market?

LS: Yes. I think you should expect that we will have additional customer announcements outside of cloud gaming.

UBS: You said over the year that revenue in semi-custom would be in the back half, but how does that breakout between September and December? I'm asking that because I'm trying to see what the gross margin will be exiting this year if you strip out semi-custom - could it be 50% exiting the year?

DK: It's hard to break it down that way. We are in the initial stages of planning for the ramp, and you're asking about Q3/Q4 - we are projecting about 80% of the semi-custom revenue growing double digits year over year in Q3 and Q4. Typically when we have this new console launches, our peak quarter from a revenue standpoint in semi-custom will be Q3. But Q4, when you talk about the ramp of the product, especially in the first year of the ramp, it's hard to project how much it will be and then what the impact will be exiting 2020 from a gross margin. Especially if you ask about excluding semi-custom. Maybe as we get close to that and talk in about three to six months, we can probably give you a better idea of that.

Q: Can you talk about what your [market] share targets are for the year in PC? I think you're 17-18 in notebook, 14 in desktop - can you talk about how much do you think that you can gain this year given all the moving parts with the shortages and whatnot?

LS: I'm not going to forecast a market share target for 2020. I will say though if you take a look back at the last eight quarters, we've been on a fairly steady share gain in PCs, somewhere between, depending on the quarter, 50 and 100 basis points per quarter. That changes between desktop and notebook. I think we grew somewhere on the order of four points of share. We believe that we still have additional opportunities; particularly our focus is going to be notebook as well as commercial and, you those are good opportunities for us and play well to our new Ryzen 4000 Mobile processors.

RBC Capital Markets: For Q4 it looks like semi-custom is probably down 50% sequentially or somewhere around the range. Am I least in the ballpark? Secondly, from a server perspective, how much of your revenues are going to be cloud versus enterprise? I think that's one of the bigger debates and I don't expect you to give specifics but anything you do to help us understand what should be the mix between Cloud and Enterprise for 2020.

LS: You're right - when you look at the semi-custom business in the fourth quarter, it was a bit softer than originally anticipated. We had originally said last quarter that we thought the second half of the year would be down high 30s - we were actually down more than that for the second half of the year and for Q4.

As it relates to the mix of cloud versus enterprise for 2020 - it will move around from quarter to quarter. But I think the best guess at this point is roughly even between the two.

SMBC: On the supply side, you are guiding for pretty strong growth here. I'm just curious, have you already locked in the supply for 7nm, and as we're going to second half of the year, especially as you ramp the game consoles, I believe that those die sizes tend to be very large. I'm just curious how you are feeling about your supply situation. Thank you.

LS: TSMC has supported us very well through the first couple quarters of our 7nm ramp here in 2019. I think as we go into 2020 there will certainly be a significant growth for us in 7nm. Our current visibility supports the revenue guide that we gave you. It is fair to say that wafer supply is tight and it's really important for us to be planning with our customers and that's what we're working on.

AMD Conference Call CEO Prepared Remarks

AMD's CEO, Dr. Lisa Su, started the financial call with the following report:

2019 marked another major milestone in our multi-year journey. We delivered record annual revenue of $6.73 billion and significantly increased both gross margin and net income as we successfully introduced and ramped the strongest product portfolio in our 50-year history. We grew client and server processor annual revenue by $1.5 billion in 2019, driven largely by the strong demand for our 7nm Ryzen and EPYC processors powered by our “Zen 2” processor core. Looking at the fourth quarter, we ended the year very strong with quarterly revenue increasing 50 percent year-over-year to a record $2.13 billion while also significantly increasing net income.

Computing and Graphics Segment

Fourth quarter revenue increased 69 percent year-over-year to $1.66 billion. Ryzen processor adoption accelerated sharply in 2019, helping to drive significant double-digit percentage increases in client processor annual unit shipments, ASP and revenue. We ended 2019 with our highest quarterly client processor unit shipments in more than six years based on strong demand for Ryzen desktop and mobile processors. In desktop, we had a very strong holiday period as our 2nd and 3rd generation Ryzen processors consistently held top sales spots at the largest global etailers and retailers. We launched our Ryzen 3950X processor and the 24 and 32 core versions of our 3rd generation Ryzen Threadripper processors in November. Our 16-core Ryzen 3950X processor is the world’s fastest mainstream desktop processor, while our latest Threadripper CPUs offer unmatched performance for the high-end desktop market. In January, we expanded our leadership position in the HEDT market with the launch of our flagship 64-core Ryzen Threadripper processor which is the world’s highest performance desktop processor.

In mobile, we had our eighth straight quarter of strong double-digit percentage year-over-year revenue growth as we expanded the number of AMD-powered laptops available from major OEMs. We began shipping our Ryzen 4000 mobile processors powered by our “Zen 2” core at the end of the fourth quarter. These new processors double the performance-per-watt of our prior generation and deliver leadership single threaded, multithreaded and graphics performance for thin and light notebooks, while enabling the industry’s first ultrathin laptops with 8 cores. Initial systems featuring the Ryzen 4000 processors are expected to launch later this quarter and more than 100 AMD-based consumer and commercial laptops are planned for 2020 from Acer, Asus, Dell, HP, Lenovo and other major OEMs.

In graphics, fourth quarter unit shipments grew by a strong double-digit percentage year-over-year, driven by sales of our Radeon RX 5000 series GPUs featuring our new RDNA architecture. We further expanded our portfolio of RDNA GPUs with the introductions of the 5500XT and 5600XT desktop graphics cards, highlighted by strong third-party reviews that clearly establish the 5600XT as the most powerful gaming GPU available for under $300. We launched our RadeonTM 5000M mobile GPUs in the quarter as well, and we are seeing solid design win momentum based on their strong performance and power efficiency. The first laptops powered by the new GPUs are available now – including the recently updated Apple MacBook Pro – and we expect many more notebooks featuring our Radeon 5000M GPUs to launch throughout 2020.

Data center GPU revenue increased sequentially driven by cloud VDI and game streaming deployments. We announced a major update to our open source GPU computing software stack in the fourth quarter featuring performance optimizations, expanded development tools and support for the most popular machine learning frameworks. We continue making strategic software investments to make it easier for developers to tap into the full capabilities of our Radeon Instinct accelerators for HPC and AI applications. For the year, data center GPU revenue grew by a strong double-digit percentage as we continued to make progress growing our presence in this important part of the market.

Enterprise, Embedded and Semi-Custom Segment

Revenue of $465 million increased 7 percent year-over-year as EPYC processor revenue growth offset declines in semi-custom revenue. Semi-custom sales continued to soften in the quarter in advance of the next-generation console launches from Sony and Microsoft planned this year. For 2020, we expect first quarter semi-custom revenue to be negligible and the ramp of next-generation semi-custom products to start in the second quarter with revenue to be heavily weighted towards the second half of the year.

In server, revenue grew by a strong double-digit percentage as unit shipments and ASP increased sequentially driven by demand for our 2nd Gen EPYC processors. Our 2nd gen EPYC processors are ramping significantly faster than the first generation as we see particularly strong pull for our higher core count models where our performance and TCO advantages are the most significant. Cloud adoption with the largest providers continues to accelerate, driven by the expanding use of EPYC processors to power their critical internal workloads as well as a significant increase in the number of AMD-powered instances publicly available. Shipments to cloud providers increased sequentially by a significant double-digit percentage to support expanding buildouts at Amazon, Google, Microsoft, Oracle and Tencent. Microsoft announced the availability of four new virtual machines and AWS announced two new EC2instances powered by 2nd Gen EPYC processors. In the enterprise, Dell began shipping their full portfolio of servers powered by our latest EPYC processors. We have doubled the number of EPYC processor platforms in market to more than 100 offerings in the quarter. These new platforms are driving increased enterprise customer engagements, broadening our sales pipeline considerably. In HPC, we secured multiple large wins in the quarter based on our unmatched performance and scalability, highlighted by French, German and UK national supercomputing center deployments as well as the San Diego Supercomputing center.

We are pleased with the significant traction and momentum in our server business and remain on track to achieve our goal of double-digit percentage unit share by mid-year based on the growing demand for our 2nd Gen EPYC processors.

Summary

I am very proud of our 2019 accomplishments as the successful ramps of our latest Ryzen, Radeon and EPYC processors resulted in record annual revenue and substantial increases in gross margin and net income. I want to take a moment to recognize the more than eleven thousand AMDers around the world whose focus and determination enabled us to achieve these results.

We enter 2020 well positioned to continue gaining share across the PC, gaming and server markets based on having an unmatched portfolio of leadership products spanning from desktops to laptops, data centers and game consoles. With more than twenty 7nm designs in production or development, we are very excited about our next wave of products that can accelerate our growth in 2020 and beyond.

We are still in the early stages of our journey and remain focused on meeting our commitments as we establish AMD as the high-performance computing and graphics leader.

AMD Conference Call CFO Prepared Remarks

Following Dr. Su, AMD's CFO, Devinder Kumar, also had prepared remarks:

2019 was an outstanding year for AMD. Our competitive product portfolio and market share gains drove the highest annual and highest quarterly revenue in AMD history. We achieved our highest annual gross margin percentage and annual free cash flow since 2011. We improved non-GAAP earnings per share by 39% year-on-year. In short, we are very pleased with our financial performance.

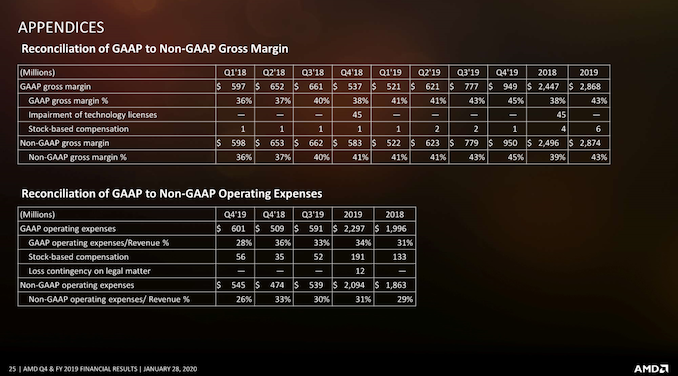

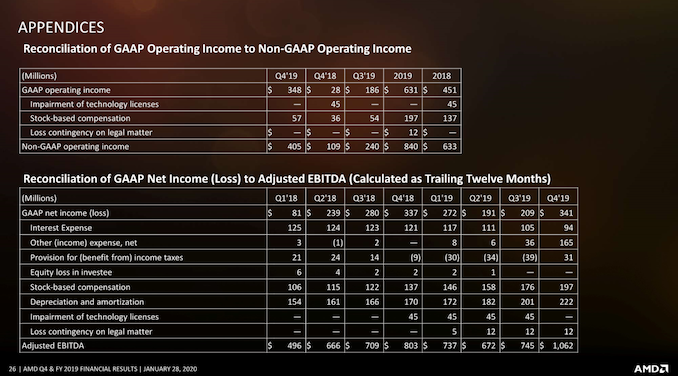

Fourth quarter revenue was $2.13 billion up 50% from a year ago, and up 18% from the prior quarter driven by strong sales of Ryzen and EPYC processors, and Radeon on GPUs, partially offset by softer semi-custom sales. Gross Margin was 45%, up 360 basis points from a year ago, driven primarily by sales of our leadership 7nm products. Operating Expenses were $545 million, with increased investments in go-to-market activities and R&D, compared to $474 million a year ago. Operating Income was $405 million, up $296 million from a year ago, driven by revenue growth and higher gross margin. Operating margin was 19% as compared to 8% a year ago. That income was $383 million, up $296 million from a year ago. Diluted earnings per share were 32 cents per share, compared to eight cents per share a year ago.

Business Segment Results

The Computing and Graphics segment revenue was $1.66 billion, up 69% year over year, driven by Ryzen processor and Radeon gaming GPU sales growth. The Computing and Graphics segment operating income was $360 million or 22% of revenue, compared to $115 million a year ago, driven by higher revenue.

Enterprise Embedded and Semi-Custom (EESC) segment revenue was $465 million, up 7% from $433 million the prior year. The continued growth of EPYC processes was partially offset by softer semi-custom revenue. EPYC processor revenue grew by a strong double digit percentage sequentially driven by robust shipments of our second generation EPYC processors. EESC segment operating income was $45 million, or 10% of revenue, driven by EPYC process sales, compared to an operating loss of $6 million a year ago.

During the quarter, we reduced gross debt by $524 million, which resulted in a GAAP loss of $128 million. These debt reductions result in an annualized interest expense saving of approximately $16 million. Free cash flow was positive $400 million in the fourth quarter, and cash flow from operation was $442 million. Inventory was $1 billion down 6% from the prior quarter. Fourth quarter adjusted EBITDA was $469 million compared to $152 million a year ago, driven by higher quarterly earnings.

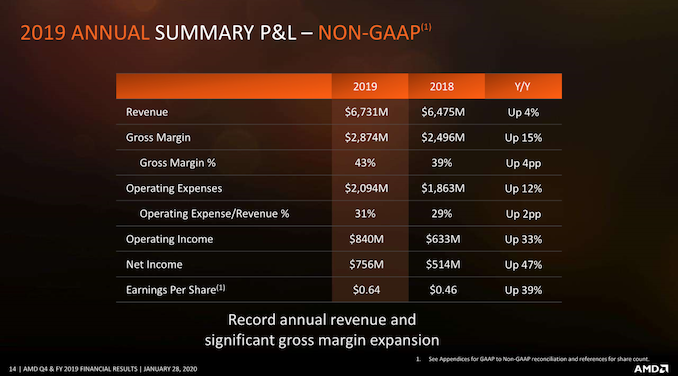

Full Year Results

2019 revenue was $6.73 billion, up 4% YoY driven by strong growth in Computing and Graphics segment and sales of second generation EPYC processors, partially offset by a decline in semi-custom sales. Excluding semi-custom, revenue was up more than 20% year over year. Gross Margin of 43% was up 420 basis points from the prior year, driven by our current generation of Ryzen and EPYC products. Operating expenses were 31% of revenue, as we increase go-to-market activities and investments in R&D. 2019 operating income was up 33% from a year ago to $840 million, or 12% of revenue. Net income was $756 million, up 47% from the prior year.

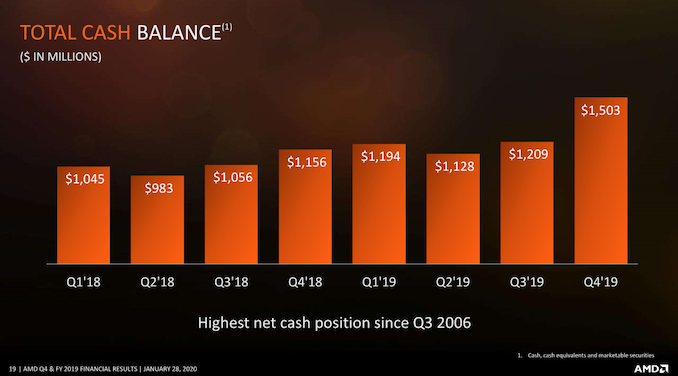

Turning to the balance sheet, I'm extremely pleased with our progress on the strengthening balance sheet. Cash, cash equivalents and marketable securities total $1.5 billion at year end, while gross debt was $563 million. This represents our highest net cash position since the third quarter of 2006. Full year free cash flow was $276 million. We reduced principal debt by almost $1 billion in 2019, and ended the year with less than $600 million of gross debt. On a trailing 12 month basis, adjusted EBITDA was $1.1 billion, resulting in gross leverage of 0.5x, down from 1.9x at the end of 2018.

Outlook for 1Q 2020

We expect revenue to be approximately $1.8 billion, plus or minus $50 million, an increase of approximately 42% year over year, and a decrease of approximately 15% sequentially. The year over year increase expected to be driven by strong growth in Ryzen, EPYC, and Radeon product sales. The sequential decrease is driven primarily by negligible semi-custom revenue, which continues to soften in advance of the ramp of next generation products, in addition to seasonality.

In addition, for Q1 2020, we expect non-GAAP gross margin to be approximately 46%. [We expect] Non-GAAP operating expenses to be approximately $580 million, non-GAAP interest, expense, taxes, and other to be approximately $18 million, and the first quarter diluted share count is expected to be approximately 1.22 billion shares.

Outlook for FY2020

For the full year 2020, we expect revenue growth of approximately 28 to 30%, driven by strength across all businesses. We expect non-GAAP gross margin, to be approximately 45%, non-GAAP operating expenses to be approximately 28% of revenue, and a non-GAAP tax rate of approximately 3% of pre-tax income.

In closing, we had an excellent fourth quarter, and an excellent 2019. Our full year financial results highlight the strength of our business model. I look forward to what we have in store for 2020 as we expect to further expand and ramp our leadership portfolio of high performance products to drive revenue growth, gross margin expansion, market share gains and financial momentum.