Original Link: https://www.anandtech.com/show/8810/wearables-2014-and-beyond

Wearables: 2014 and Beyond

by Stephen Barrett on January 15, 2015 11:50 AM EST- Posted in

- Apple

- Microsoft

- Wearables

- pebble

- Android Wear

- Microsoft Band

- Fitbit

As the year 2014 has come to a close, now is a good time to inventory changes in the consumer electronics market and project those trends forward. One of the most obvious changes was that wearable technology has, by my observation, approached the brink of the adoption chasm into the early majority. In this article we will focus on the significant business and consumer factors of wearable technology, the notable introductions in 2014, as well as future AnandTech coverage.

If you are unfamiliar with ‘the chasm’, this is a reference to an acclaimed technology marketing book by Geoffrey A. Moore in 1991. As seen in the figure below, Geoffrey describes five stages of adoption.

The first, consumers described as innovators, are on the very bleeding edge. Innovators have a combination of unique interest in the subject area and abundant disposable income. There is a small chasm between this group and the next. This small chasm has killed many technologies and you could probably argue that 3D TVs died here. Next, early adopters are more like typical AnandTech readers. These consumers are technologically savvy and often the technology go-to person for groups of family and friends. Early adopters are likely to have made investments into products that their friends have yet to invest in themselves. My wife described me this way when I made the jump from iPhone to Windows Phone. It was an early product without majority adoption (and still is), but I wanted it anyway.

This brings us to The Big Scary Chasm in Question. How does a technology explode from a “hobby”, as famously Apple described its Apple TV, to a staple like the iPhone? In the information age of today, crossing this chasm is primarily a focus of marketing. Sure, you need good product, but without effective marketing there is little chance of wide adoption. There are plenty examples of products that have been favorably reviewed by AnandTech and others but didn't see widespread adoption. Often, it's a case of competing against the marketing budget of a much larger company, but that's a topic for another day. In short, going from a cult hit to a market leader is difficult; hence, the Chasm.

Taking this back to wearables, 2014 saw the most marketing of wearables yet, and for good reason. The traditionally explosive smartphone and tablet markets are slowing down. Analysts at CCS Insight projected a fall of smartphone sales' yearly growth from 40% in 2013 to 25% in 2014 and 15% in 2015. Analysts at Gartner project a fall of tablet sales' yearly growth from 55% in 2013 to 11% in 2014. IDC projects 2014 tablet growth even worse at 7%. At the same time, wearable revenue is projected to dramatically grow. ABI Research projects wearable technology at a compound annual growth rate (CAGR) of 56.1% over the next five years. Finally, Price Waterhouse Coopers’ interview samples show that 76% of consumers do not need a new wearable device to replace functionality of an existing device.

The top consumer eco system players – Apple, Microsoft, Google, and Google’s partners – are growth companies. Continually increasing revenue is a corporate foundation. Without revenue growth, careers stagnate as no promotions or raises are possible. Go long enough without growth and your top talent can leave for a company with growth opportunity. In Samsung’s recent 3rd Quarter financial results, their revenue fell 20% year over year and Samsung primarily attributed this to smartphone struggles.

With all this data combined, it is a no-brainer for these consumer companies to shift resources to wearables. Therefore, all have made significant wearable announcements. Google’s partners and Microsoft have launched devices while Apple is alone in the laggard position of having nothing on the market (with Apple Watch coming this year).

Wearables: What Are They?

At their core, wearables are of course technological devices that you wear. In some sense, your smartphone is actually a wearable. Even though a smartphone usually does not directly contact your body, it is a wearable just as much as a smart purse or backpack is a wearable. However, as smartphones are already a category of their own, they are traditionally excluded even though the core technology is vastly similar. That core technology consists of sensors, wireless, storage and computing. Intel’s recent IoT (Internet of Things) platform launch contained a slide detailing the cost reduction of some of these components, which is an enabling factor of wearable growth.

Where wearables differ from smartphones is their function. By breaking from the traditional smartphone form factor a wearable can provide different benefits. These benefits can be broken down into different categories that closely mirror the contents of the device as different sensors, processors, wireless, and storage enable different use cases.

On the left side of the above diagram from ARM are devices that contain wireless connectivity, sensors, a low power microcontroller such as Coretex-M, small amounts of memory and storage; run an embedded OS; and potentially have an optional display. The vast majority of these devices today are for fitness and health, however some provide smart watch functionality as well. On the middle and right side of the diagram are devices that integrate higher end processing and storage such as full-blown application processors (think Cortex-A series) and DDR memory. These allow running richer, non-embedded operating systems (such as Android) and higher-end features at the cost of power consumption.

Wearable Use Cases

Inevitably in any wearable discussion with friends or family, one of the first questions asked is “why?” The general public sees the value provided by smartphones clearly, but with wearables that is not always true. In an effort to describe wearable value in general, I will present the top two use cases – fitness and smart watch. Hopefully this provides some context of where wearables are now and where they can go in the future. Future device reviews at AnandTech will have use cases like these in mind when evaluating the quality of a wearable.

Fitness

Moving Distance

Today, fitness wearables have typically provided the most benefit to runners, walkers and cyclists, or just about anyone moving a distance through their own effort (kayaking, canoeing, rollerblading, etc). This is due to a good match of user needs and wearable technology’s specialized ability to meet those needs. A summarized list of care-abouts yields:

- Notification when reaching distance markers – to keep track of progress toward goals

- Notification of speed traveled at each distance marker – to make sure to achieve pace goal

- Overall speed – to make sure to hit pace goal

- Elapsed time – to help schedule a day or meet people at certain times

- Length traveled – to help meet personal fitness goals

- Heart rate – to measure body strain and assist in pacing

- Calorie counting – to aid in personal fitness plan goals

- Map of travel detailing pace – to review pacing and share via social media

- Make calls – to handle an emergency

- Listen to music and podcasts – for motivation and entertainment

- Elevation tracking – to review effort and share via social media

- Connectivity – to interface to other devices like a cyclist’s power meter or a treadmill’s display

Solving all of these with a wrist-worn wearable provides unique value, as the form factor is significantly better than the girth of increasingly large smartphones. Additionally, the display is more conveniently accessible than an arm-band mounted smartphone. However, running or cycling while looking at your wrist is still inconvenient so Bluetooth audio notifications and connectivity to gym bikes and treadmills is desired.

Mapping wearable features to this list yields an imperfect but good result. Note that distance traveled is actually a fairly difficult thing to compute indoors or without GPS assistance, and relies on sensor fusion of compass + gyro + accelerometer passed to a pedometer algorithm.

- Notification when reaching distance markers – Sensor fusion / GPS, Bluetooth audio, Vibration, Display

- Notification of speed traveled at each distance marker – Sensor fusion / GPS, Bluetooth audio, Vibration, Display

- Overall speed – Sensor fusion / GPS, Display

- Elapsed time – Display

- Length traveled – Sensor fusion / GPS, Display

- Heart rate – Pulse oximeter

- Calorie counting – Sensor fusion

- Map of travel detailing pace – Sensor fusion / GPS

- Make calls – Cellular, Microphone, Bluetooth audio / Speaker, Phone contacts sync

- Listen to music and podcasts – Bluetooth audio, Large data storage

- Elevation tracking – Barometer / GPS

- Connectivity – ANT+ / Bluetooth Low Energy

Nearly every need is met by the hardware technology available in wearables on the market today. However, there are a few missing hardware pieces. Cellular functionality has yet to become widely available (outside the Tizen based Samsung Gear S) due to power consumption, miniaturization, and cost constraints; ANT+ support meanwhile is mostly missing. There are a few ANT+ enabled wrist-worn wearables, but none from Apple, Microsoft, or Google’s partners.

As cyclists commonly have ANT+ chest-mounted heart rate monitors, ANT+ power output meters, and ANT+ cycling computers, the lack of ANT+ on a wrist worn wearable seems like a missed opportunity. For example, a cyclist could replace their cycling computer and chest-mounted heart rate monitor with an ANT+ enabled wrist-worn wearable but retain their investment in the ANT+ power meter. The same goes for the many gyms that have ANT+ enabled equipment.

In my experience with the movement use case and today’s wearables, the hardware is very close but the software has not yet come up to my expectations. This is an incredibly competitive target at the moment that has not yet seen a clear winner or consolidation.

Weight Lifting

While fitness has been a key marketing point of many wearables in 2014, the products involved have yet to pertain to a key demographic of fitness conscious people: weight lifters. This is what I would consider a forward looking wearable target.

I certainly would not consider myself a body builder or gym rat but I do enjoy lifting weights much more than any moving exercise – and I am not alone. There are plenty of people in the world of gyms that spend their time using weights and not treadmills. Therefore, I find myself somewhat annoyed when wrist worn wearables are marketed as fitness devices but have a fraction of the value (or no value) to a weight lifter versus a runner. Personal thoughts aside, compiling a list of a weight lifters care-abouts yields a quite different list that highlights why this demographic has yet to be successfully targeted:

- Heart rate – to measure body strain and assist in pacing

- Exercise tracking – automatic detection of weight usage and exercises performed to provide historical tracking of gains and loses

- Personal record tracking – keep personal records (PRs or ‘bests’) data for each exercise

- Body fat and muscle measurement – keep track of body fat burn and muscle build over time

- Suggested exercises – utilize historical exercise data and muscle atrophy over time and provide intelligent suggestions for today’s exercises. Customizable to constrain suggestions to available gym equipment

- Suggested weight – when starting a new exercise, suggest a starting weight based upon personal information

- Fatigue tracking and warning – track muscle fatigue by muscle at the gym and over time. Utilize data to provide warnings when to stop lifting and when to revisit the gym

- Social features – compare and track with friends

The number one issue here is the lack of technology for automatic weight and exercise tracking. While there are weight lifting smartphone apps with manual data entry, these do not compare to the simplicity of automatic tracking runners and cyclists enjoy. Part of the reason products such as Fitbit became popular is their convenience. There is little more needed from the user than to wear the device and review the acquired data.

This is a solvable problem. Gyms of the future could contain NFC or Bluetooth enabled weights and machines. A wrist-worn wearable could track usage and movement of your body compared to the weights and conclude which exercises you performed and what weight used. Once that data is available, analysis based upon body type becomes possible and suggestions can be made. Combined with today’s heart rate and body fat sensors and weight lifters could find their perfect wearable and their favorite gym. There are efforts in the weight lifting wearable area now (see Push), but without automatic tracking they are currently second fiddle to the moving use case.

Smart Watch

The smart watch use case is what I would consider immature. After some failed efforts from 2003 to 2009 from Samsung, Palm, and Microsoft, Pebble awoke the market in 2013 with a Kickstarter campaign. In 2014 the major players of Microsoft, Google, and Apple each targeted this market but none have perfected it. One of the main problems of this use case is parameterizing it. What unique value does a watch offer over a smartphone? Thus, many times smart watch functionality is combined with fitness functionality that can only be offered by a wearable.

Compiling a list of smart watch care-abouts yields:

- Time – need to replace a basic time telling watch

- Customizable watch face – need to replace the tens (hundreds?) of thousands of basic time telling watches

- Physically attractive – if I am going to wear it every day, it cannot look like a toy

- Comfortable – if I am going to wear it every day and sleep with it on, it cannot hurt or bother me

- Water resistant – to survive washing dishes, hands, weather. Ideally IPx7 or greater

- Rich smartphone notifications – keep track of what is happening even if the smartphone is not directly available, such as across the room or in a purse. Optionally dismiss or respond. All notifications should arrive to prevent missing some by relying on the smart watch

- Voice assistant – quick answers like what is the weather or when is the Cowboys' game

- Alarm clock – vibrate function to avoid waking up a partner

- Calendar – easily display my next meeting details such as where it is located

- Messaging – easily send quick messages and replies with SMS or other apps such as Facebook messenger

- Tasks and Reminders – create Exchange / Google tasks by voice and reminders

Nearly all of the actual features of a smart watch come directly from smartphone use cases. The difference is they are slightly tweaked toward the wrist-worn use case. When using a smart watch, the main benefit is getting things done even quicker than with a smartphone. It only takes a moment to rotate your wrist and say “OK Google, Wake me up at 7am” versus finding wherever your phone is, activate it (if no passive listening exists), say the same thing, and put it down somewhere safe. It is amazing to think that shaving these seconds off each interaction can have value, but when you add up each time you touch your smartphone every day it does quickly add up.

However, as many point out, these devices lack the killer app. There isn’t much they can do that your smartphone cannot. The vibrate alarm is one example, but there has to be more. Apple examined some ideas during their Apple Watch keynote such as pairing multiple watches. Taps on a watch sends a corresponding taps to others – useful for spy movies and tense corporate meetings. Until a smart watch specific killer app releases, AnandTech will evaluate the execution quality of the essentials listed above.

Fitness and smart watches were the clearest targets for wearables in 2014, however there are a variety of other wearable technology targets such as personal trainers, hair pieces, eye pieces (Google Glass), and clothing that will be interesting as they mature in the future.

Wearable Products in 2014

While Pebble arguably resurrected the wearables market in 2013, the biggest year yet was 2014. Many products (and several whole platforms) became consumer available. Many of these devices bring new innovations to the table to expand wearables from simple pedometers to full blown smartphones on your wrist and comprehensive health trackers. It is impractical to do a full review of each launch in the past year, so here are some wearable product highlights from 2014 to lay the foundation for future device reviews in 2015.

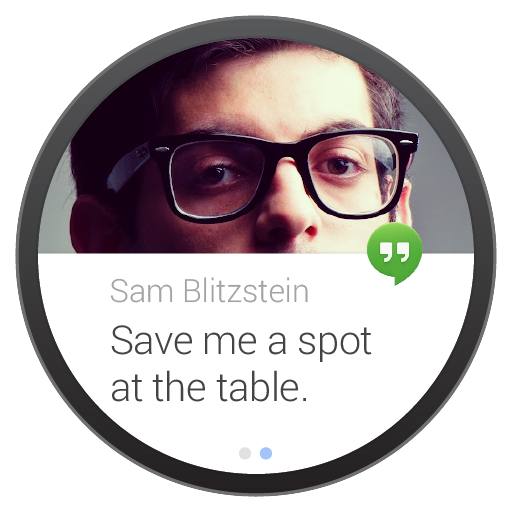

Android Wear

Arguably the biggest wearable launch this year was its very first platform OS. Android Wear aims to be the Windows of the smart watch market, enabling device makers to create devices without significant software investment by loading Android Wear. This strategy clearly worked well for Microsoft with PCs and Google with smartphones.

Android Wear is a wearable tailored version of the base Android OS, not a new creation. This provides immediate benefits as device makers can bring up wearable hardware with all the knowledge gained from previous smartphone efforts. As Android (without heavy modification) is not an embedded microcontroller OS, Android Wear devices rely on full featured application processors such as the Cortex-A or MIPS variety, not Cortex-M. Android app developers can create and deploy Android Wear apps using nearly all of the same APIs from traditional Android development. Differences between traditional Android and Android Wear are detailed in the development assistance provided by Google.

Currently, the foundation of Android Wear is not running apps. Rather, it is pairing with an Android 4.3+ device and providing Google Now features. Activating your Android Wear device provides the same list of cards on your wrist that are available in the Google Now page of your Android phone, and they are acted upon and dismissed in a similar way. How much you like Android Wear comes down to how much you like Google Now. “OK Google” voice activated assistance is always on when the device is not sleeping, and bringing a device out of sleep is done via motion detection. Moving and twisting your arm from any position to the position needed to view the watch face activates an Android Wear device. If the device is already in this position and has gone to sleep, you can tap or press a button to wake the device.

Because the majority of functionality is provided by Google Now and the rest by loading apps, each Android Wear device launched provides a nearly identical experience. Thus, purchasing decisions between Android Wear devices fall entirely into the hardware camp. This is not something to be quickly disregarded or dismissed, as the selection of wrist hardware is a very personal choice. A watch’s band material, size, and styling can make or break a device.

For example, the Moto360 I have been using is entirely black with a black leather band. To be honest, I do not like the styling as I think it looks childish. The leather band also absorbs water which limits how I use the device. However, surveying my friends and family, many of them do like the all black and leather styling. To address this, Motorola sells many style variants. Personally, I would purchase the light shade stainless steel and wear that Moto360 a lot more.

Six Android Wear devices have launched and are available via the Google Play Store and some other retailers.

LG G Watch, Moto 360, ASUS ZenWatch

Samsung Gear Live, Sony SmartWatch 3, LG G Watch R

Android Wear launched focused on smart watch features alone. However, in an October update, Google added support for heart rate monitoring, Sensor Fusion / GPS, and music storage and playback via Bluetooth Audio. This provides the framework for the moving (running, cycling, etc.) use case, but Google relies on app support for moving software. In my personal experience, running app support is rough around the edges. For example, the premier running app highlighted by Google (Runtastic) does not support the heart rate monitor nor does it work disconnected from your phone, mostly defeating the experience.

New hardware has also launched since Android Wear’s introduction. The Sony SmartWatch 3 launched in October alongside the new GPS support. Additionally, there have been several OS updates including a Lollipop update landing on my Moto360 very recently (ironically before my Galaxy S4 has Lollipop).

This is possibly the strongest aspect of Android Wear. It is a full blown smartphone OS offering 3rd party app support, continually developed and improved by a company (Google) that is not the hardware vendor. Updates are frequent and quickly deployed. Google is building a foundation of software and hardware to foster an ecosystem. Right now it is far from perfect, but the good news is that if you buy an Android Wear device today, that device will likely be become significantly different and better over time via software and apps updates.

Samsung

While Samsung is traditionally thought of as a huge Android smartphone vendor, Samsung diverges from Google when it comes to wearables with some interesting results. When Samsung was developing their first wearable, the Galaxy Gear, in 2012 and releasing it in 2013, Android Wear did not exist. Rather than wait for Google (as Samsung did when Google was rushing to release Android 3.0 for tablets to catch up to Apple and the iPad), Samsung went ahead and forked Android themselves. We reviewed the Galaxy Gear shortly after its launch.

This is important history, as it explains the state of things today and throughout 2014. As Samsung did not wait for Android Wear, their first device contained features Samsung defined, such as camera and IR support, without collaborating with Google. Thus, Samsung wearables were in an interesting position of being off-platform from Google and thus not benefiting from Google’s ecosystem efforts, while also containing features and innovations that could not be folded into Android Wear. For example, if Samsung updated the software on the Galaxy Gear to Android Wear, the camera would stop working.

This is both a good and bad position. Samsung has now transitioned most of their smart watches to their own operating system, Tizen, so they can innovate without needing to coordinate with Google. However, apps designed for Android Wear of course cannot run on Samsung’s Tizen smart watches. Thus, Samsung is currently in its own category. Samsung and Google are now in a race to see who can build an ecosystem faster.

If Samsung can win, they do not have motivation to transition to Android Wear. If Google wins and adds in features that Samsung’s smart watch build of Tizen has, then Samsung should likely migrate their devices over to Android Wear. This will be an interesting power struggle to observe in 2015. It should also be noted that Samsung does make one Android Wear device, the Samsung Gear Live, likely to hedge its bets.

Samsung’s devices and OSes are listed below in the order they were released:

- Samsung Galaxy Gear – released as custom Samsung Android fork; upgradeable to Tizen

- Samsung Gear 2 – Tizen

- Samsung Gear 2 Neo – Tizen

- Samsung Gear Fit – Low level embedded OS (Cortex-M4 CPU)

- Samsung Gear Live – Android Wear

- Samsung Gear S – Tizen

Every device other than the Gear Fit are smart watches. The Fit instead focuses mainly on fitness but also has some smart watch functionality. Technically the category is “Fitness Wristband”. In fact, the Gear Fit hardware is similar to the Microsoft Band that we will cover later.

In 2014 Samsung launched a very interesting device, the Gear S. This is effectively a smartphone on your wrist, as it is the first wrist worn wearable to include cellular (3G) and WiFi. It even has a SIM card slot. This is a clear example of where Samsung has diverged from Android Wear features. It also contains a unique curved Super AMOLED display. These curved displays have dubious value in a smartphone but are more obviously useful on a wrist worn device.

With cellular connectivity, the Gear S sits alone as the only wearable you can wear without a connected smartphone on a cycling, canoeing, or running trip yet still make an emergency call or sync up with friends. Samsung also collaborated with Nike to bring the very popular and feature rich Nike+Running app to their Tizen based smart watches. Therefore, from a checkbox perspective, the Gear S might be the most interesting fitness and smart watch wearable launched in 2014. However, a full review is needed to ascertain how well Samsung executed on the entire experience.

Wearable Products in 2014

Microsoft

In 2014, seemingly out of nowhere (as there were no leaks or press ahead of time), Microsoft launched their first wearable since 2004 with the Microsoft Band. The Microsoft Band utilizes a Cortex-M4 processor and thus runs an embedded OS, not Windows NT. As with other devices using microcontrollers, its first focus is fitness tracking and not smart watch functionality (although that is also included). Microsoft however does fitness slightly differently than their competitors and actually regards this as the launch of both the Microsoft Band and their health platform, Microsoft Health.

Microsoft Health is a cloud service, such as OneDrive, that aims to help improve the health of its users through data analysis and actionable feedback. Activity tracking devices and apps that connect to Microsoft Health publish data, with your permission, to the Microsoft Health server. Microsoft claims their cloud data framework and analysis provides the only total health service available. Additionally, the Microsoft Health framework is referred to as an open platform, therefore other companies can interface with it as both publishers of data and subscribers of analysis. Microsoft Health also connects to the existing Microsoft service, HealthVault, which contains personal and family medical information and lab results.

The Microsoft Band itself is the combination of 10 sensors, including some interesting ones such as skin temperature, UV light, and galvanic skin response. Uniquely, the Microsoft Band works with all three major mobile operating systems (iOS, Android, and Windows Phone) by connecting to the corresponding Microsoft Health app. However, you can perform activities (such as running) without a paired device.

Another unique feature is the continuous heart rate monitoring. Other devices, such as Android wear, only periodically query the wearer’s heart rate. Microsoft claims this allows them to do better holistic analysis of health. In my experience with the Moto360, depending on how tight you wear the device, the heart rate sensor may not work. Comparatively, the Microsoft Band is mechanically designed so the best way to wear it is always in close contact with your skin. Finally, Microsoft will even license the electronics and software design of the Microsoft Band for other companies to create their own wearables connected to Microsoft Health.

The band itself provides some smart watch features such as calendar, email, and messaging notifications. When paired with a Windows Phone, Cortana support is also available for similar functionality to Google Now. One difference between Android Wear and the Microsoft Band is with app interfacing. As mentioned previously, Android Wear relies on apps running alongside (on your smartphone) or on the device to do things such as run tracking. The Microsoft Band instead has built in support for run tracking, and can publish that data to both Microsoft Health and any compatible app like RunKeeper. Therefore, the Microsoft Band out-of-the-box has several fitness related functionalities without relying on 3rd party apps.

Given my less-than-stellar experience with RunKeeper providing run tracking on Android Wear, a first party approach to fitness is appealing. However, it remains to be seen if Microsoft can keep pace with the wide open field Android Wear provides to app makers.

All of this combined makes a strong argument that Microsoft is ahead of their competition for health related wearables. Google has Google Fit, which plans to provide similar cloud-health functionality and already has some APIs for apps to connect with it, but the web site for Google Fit is downright embarrassing and looks like a simple placeholder with almost no valuable information. Google also had Google Health, which was similar to Microsoft HealthVault, but Google shut down the service in 2011.

I have requested a Microsoft Band for review to analyze how well Microsoft has executed both the Band and Health launches. There are of course other aspects to the Band (such as guided workouts) I will cover at that time.

Apple Watch

While this is a 2014 year in review article and Apple technically did not launch anything in 2014, it is worth mentioning their announcement of the Apple Watch. In America at least, it is often the case that a technology will arrive on the market well ahead of Apple’s embrace and not see widespread acceptance. When Apple finally deploys the same technology, the technology crosses the chasm and sees widespread proliferation. NFC payment and Apple Pay are a good example. I saw one or two places offering NFC payment before Apple Pay; now there are dozens. Therefore, Apple announcing the Apple Watch is a watershed moment for wearables.

Officially coming to market in spring 2015, the Apple Watch experience appears to be more similar to Tizen based Samsung devices than Android Wear. To start with, the device itself contains WiFi in addition to Bluetooth and therefore should have more freedom than a standard Bluetooth enabled wearable. The core functionality of the device also does not revolve around Siri but appears to be a full blown iOS style launcher.

The Apple Watch likely uses an application processor (AP) and does not rely entirely on a microcontroller. This also correlates with the Apple estimated battery life of one day due to high consumer usage, as an AP will draw more power than a microcontroller when in use. The exact quote from Tim Cook is, “I think given my own experience, and others around it, that you’re going to wind up charging it every day. Because you’re going to use it so much.” Utilizing an AP opens the doors to more use of frameworks and APIs than low-level embedded coding, and therefore facilitates the 3 party app model.

Apple intelligently recognized the need for personalization and styling in a wrist worn wearable and will offer a staggering 34 different models of the device with varying cases, sizes, bands, and editions (Sport, Standard, Gold). Two interesting innovations set to launch with the device are a pressure based touch screen and a tap feedback output, providing a tap sensation in addition to a traditional vibration. We will have more coverage of the Apple Watch when it launches in 2015.

Others

Several other wearables exist (and are more popular in the case of Pebble and Fitbit), but these are going to face an increasingly difficult battle for relevancy in the face of efforts from the main software ecosystem players – Apple, Microsoft and Google. However, Microsoft’s strategy of licensing hardware design and Android’s more off-the-shelf operating system approach means we should continue to see unique wearables going forward.

Pebble Steel

Pebble is likely the most mature smart watch wearable at this point, given its launch in 2013. Pebble devices possess many days of battery life, a unique perk over the competition. Pebble owes its battery life to the use of a low power microcontroller, low resolution e-paper display, non-touch screen, and only three sensors (accelerometer, compass, light sensor). Therefore, this is certainly not a smartphone on your wrist.

Interfacing with Pebble is accomplished with the set of four buttons on its sides. Pebble began as a dedicated notifications assistant, relaying notifications from paired devices, but has since expanded with some simple apps from 3rd party developers like QR code display to more complex apps such as GoPro control and RunKeeper. In 2014, Pebble launched the follow up, Pebble Steel. The Pebble Steel upgrades the mechanics from plastic to metal, and as I noted with my time using the leather banded Moto360, metal is much appreciated.

Pebble boasts the best water resistance of the lot, at an incredible 50 meters of depth. Other devices sporting IP67 are only okay up to a meter for 30 minutes, meaning if you jump into a pool you need to be very careful how far you let your arm drift down so you might as well take the device off.

FitBit Charge and Surge

Fitbit launched as an activity tracker in 2008 and has since been iterating on their designs. The first several revisions were clip on devices attached to your clothing, but since the Fitbit Flex in 2013 all have been wrist worn. I personally see wrist worn Fitbit devices everywhere and even worn as fashion accessories. My sister wears a Fitbit that is so decorated with 3rd party accessories it is difficult to discern it as a Fitbit instead of a simple bracelet.

These devices track steps taken, calories burned, and distance traveled. They can also do sleep tracking if you wear them 24 hours a day. Groups of coworkers or friends can use a connected smartphone app with social features to compete on how many steps taken and individuals can set personal step goals.

The Fitbit Charge launched in November 2014 and contains a small OLED display that boosts the utility of the Fitbit. The display shows the time, how many steps taken, and displays caller ID if your paired smartphone rings. The time and steps taken display are of notable utility as they prevent a trip to a pocket or purse to find the same information.

The Fitbit Charge HR supplements the Charge with a heart rate sensor. This expands the Fitbit further into a fitness device and begins pushing Fitbit into active activity tracking, such as running or cardio workouts. Alongside launching the Charge HR, Fitbit also expanded their app to record workouts, food eaten (through a barcode scanner or manual entry), and badge earning through workout goals. This was a significant launch for Fitbit to leverage their popular steps tracking position into remaining competitive with the bigger smart watch players.

The Fitbit Surge was announced in 2014 but will launch in early 2015. The Surge adds GPS and an LCD display to extend Fitbit’s activity tracking and smart watch functions.

Final Words

While consumers may see the wearable market as early or immature, their proliferation seems inevitable. Wearables have not quite crossed the chasm yet, but the investment major consumer companies are making is only going to grow. Functionally, some use cases such as running are fairly well addressed now, and if you’re an avid runner you could be quite pleased with the developments of 2014. For other use cases such as smart watches or weight lifting, there is still a ways to go. Socially, people have accepted passive activity trackers like Fitbit but are still getting used to wearables such as smart watches or Google Glass.

Tracking the market through 2015 will be interesting as Microsoft’s Health platform does battle with Android Wear and Google does battle with Tizen. The Apple Watch launching in early 2015 could also be a watershed moment for wearables if those devices enter the main stream. All the while, smaller (but more established) players like Fitbit and Pebble continually improve to prevent gains by the big three.

You may have noticed that AnandTech has only performed one comprehensive wearable review. Admittedly, part of the reason has been finding time between all the other important launches, but another reason is we would like reader feedback on content. What do you desire from an AnandTech wearable review? Battery life testing is obviously important, but what about other tests or subjective analysis? Is wearable screen quality important to you? Voice recognition? Durability? Obviously all things are important to some degree, but providing feedback will help us focus. Please use the comments thread below to describe why you are, or are not, interested in wearables as well as aspects of wearables that require evaluation for you to find value.

I mentioned I have a Moto360 in house and have requested some other samples. Your feedback and these devices will combine for increased wearable content in 2015.