Original Link: https://www.anandtech.com/show/15045/amd-q3-fy-2019-earnings-report-party-like-its-2005

AMD Q3 FY 2019 Earnings Report: Party Like It’s 2005

by Brett Howse on October 29, 2019 10:30 PM EST- Posted in

- CPUs

- AMD

- Financial Results

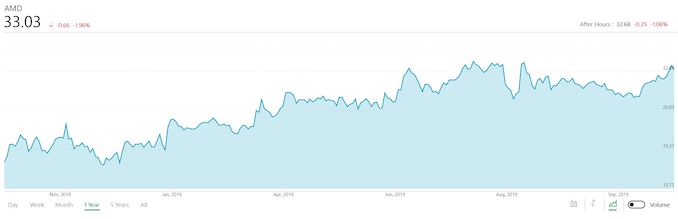

Today AMD announced their third quarter earnings for the 2019 fiscal year, and AMD has not seen revenue like this for a long time – in fact this is the highest quarterly revenue since 2005 for the company. AMD’s revenue jumped 9% year-over-year to $1.8 billion, and at least as importantly, AMD had gross margins of 43%, which is up 3% over last year, and the highest margins they’ve seen since 2012. Operating income was up 24% to $186 million, and net income was up 18% to $120 million. This resulted in earnings-per-share of $0.11, up 22% from Q3 2018.

| AMD Q3 2019 Financial Results (GAAP) | |||||

| Q3'2019 | Q2'2019 | Q3'2018 | |||

| Revenue | $1801M | $1531M | $1653M | ||

| Gross Margin | 43% | 41% | 40% | ||

| Operating Income | $186M | $59M | $150M | ||

| Net Income | $120M | $35M | $102M | ||

| Earnings Per Share | $0.11 | $0.03 | $0.09 | ||

This is the first full quarter for AMD since the launch of their 7 nm Zen 2 processor, and AMD attributes the revenue growth to the Computing and Graphics, but offset by lower revenue in Enterprise, Embedded, and Semi-Custom. Revenue for the Computing and Graphics segment was up 36% year-over-year to $1.28 billion, thanks to both increased volume and Average Selling Price (ASP) for Ryzen on the desktop. GPU ASP also increased year-over-year thanks to higher channel sales. The Computing and Graphics segment had operating income of $179 million, which is up 79% from a year ago.

| AMD Q3 2019 Computing and Graphics | |||||

| Q3'2019 | Q2'2019 | Q3'2018 | |||

| Revenue | $1276M | $940M | $938M | ||

| Operating Income | $179M | $22M | $100M | ||

Enterprise, Embedded, and Semi-Custom had revenue of $525 million for the quarter, down 27% year-over-year, mostly attributed to semi-custom sales, which makes sense since a large chunk of that is for the AMD APU powering both the Sony PlayStation 4 and Microsoft Xbox One, both of which are scheduled for new models in the next calendar year. Offsetting this was higher EPYC processor sales, although not enough of an offset to cover the semi-custom drop. Operating income for this segment was $61 million, down 29% from a year ago.

| AMD Q3 2019 Enterprise, Embedded and Semi-Custom | |||||

| Q3'2019 | Q2'2019 | Q3'2018 | |||

| Revenue | $525M | $591M | $715M | ||

| Operating Income | $61M | $89M | $86M | ||

Finally, AMD’s All Other category reported an operating loss of $54 million, which is a 50% larger loss than a year ago.

AMD had some big news in Q3, with multiple design wins for both Ryzen and EPYC, including Cray’s Shasta supercomputer leveraging 2nd Generation EPYC, and AMD getting a big design win in the PC space with the Microsoft Surface Laptop 3.

Looking ahead to Q4, AMD is expecting revenue of $2.1 billion, plus or minus $50 million, with a Non-GAAP gross margin of approximately 44%.

Source: AMD Investor Relations